Born in 1924, Charlie Munger was an American businessman, investor, and philanthropist. He graduated from Harvard Law School and served in the U.S. Army Air Corps during World War II. After the war, Munger began his career as a real estate attorney, but soon transitioned to investing, where he made his fortune through a series of stellar investments.

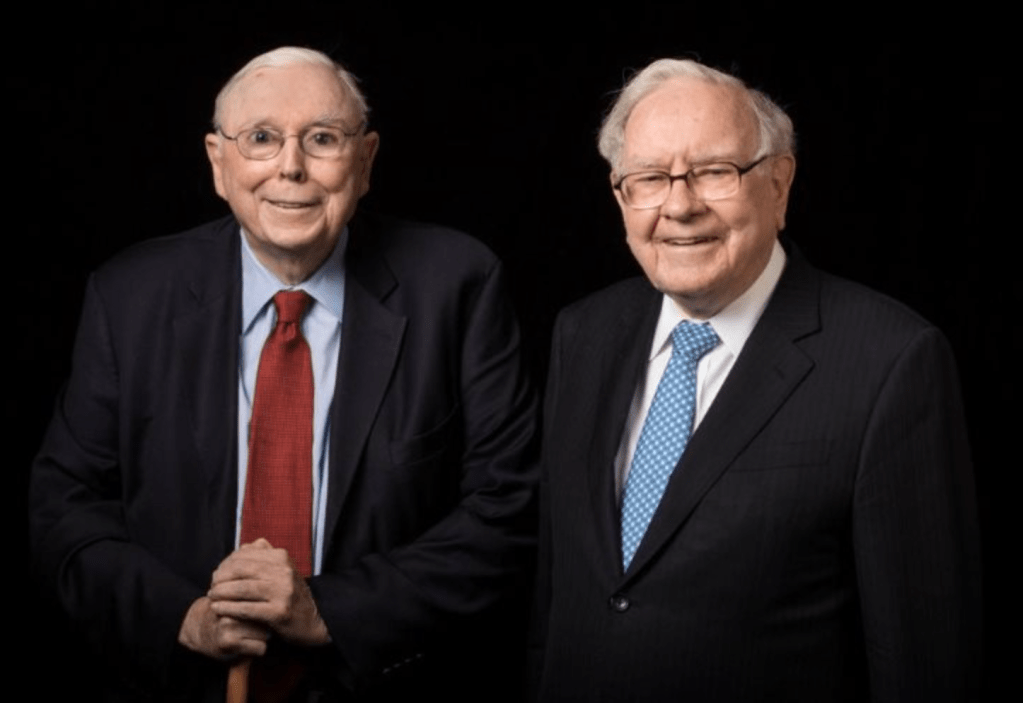

The Partnership with Warren Buffett

Munger’s partnership with Warren Buffett began in the 1970s, when he joined Berkshire Hathaway as vice chairman. Together, they formed one of the most successful investment duos in history, with Munger serving as a sounding board for Buffett’s ideas and providing valuable insights of his own.

Munger’s Investment Philosophy

It takes character to sit with all that cash and to do nothing.

I didn’t get top where I am by going after mediocre opportunities. – Charlie Munger

Charlie Munger’s investment approach is centered around several key principles:

- Long-term thinking: Munger emphasized the importance of taking a long-term view when investing, rather than focusing on short-term gains.

- Quality over quantity: He prioritized investing in high-quality businesses with strong fundamentals, rather than trying to diversify across a large number of lower-quality investments.

- Mr. Market: Munger, like Buffett, viewed the stock market as a moody business partner, known as “Mr. Market.” He advocated for taking advantage of Mr. Market’s irrational behavior to buy quality companies at discounted prices.

- Circle of Competence: Munger often stressed the importance of staying within one’s “circle of competence,” or area of expertise, when investing. This means avoiding investments in areas you don’t fully understand.

Lessons from Charlie Munger

So, what can we learn from Charlie Munger’s wisdom and experience? A lot.

- Be patient: Investing is a long-term game. Avoid getting caught up in short-term market fluctuations and focus on building wealth over time.

- Focus on quality: Prioritize investing in high-quality businesses with strong fundamentals, rather than trying to chase quick profits.

- Stay informed, but avoid noise: Stay up-to-date on market news, but avoid getting caught up in sensationalized headlines or short-term market volatility.

- Cultivate a growth mindset: Continuously educate yourself and expand your circle of competence to make informed investment decisions.

- Avoid debt: Munger is known for his aversion to debt, emphasizing the importance of living below your means and avoiding high-interest debt.

Charlie Munger’s wisdom offers valuable lessons for investors and individuals seeking to build wealth and achieve financial freedom. By adopting a long-term perspective, prioritizing quality investments, and staying informed, we can all benefit from Munger’s timeless insights. As we navigate the complexities of personal finance, let us draw inspiration from Munger’s remarkable life and investment philosophy.

You must be logged in to post a comment.