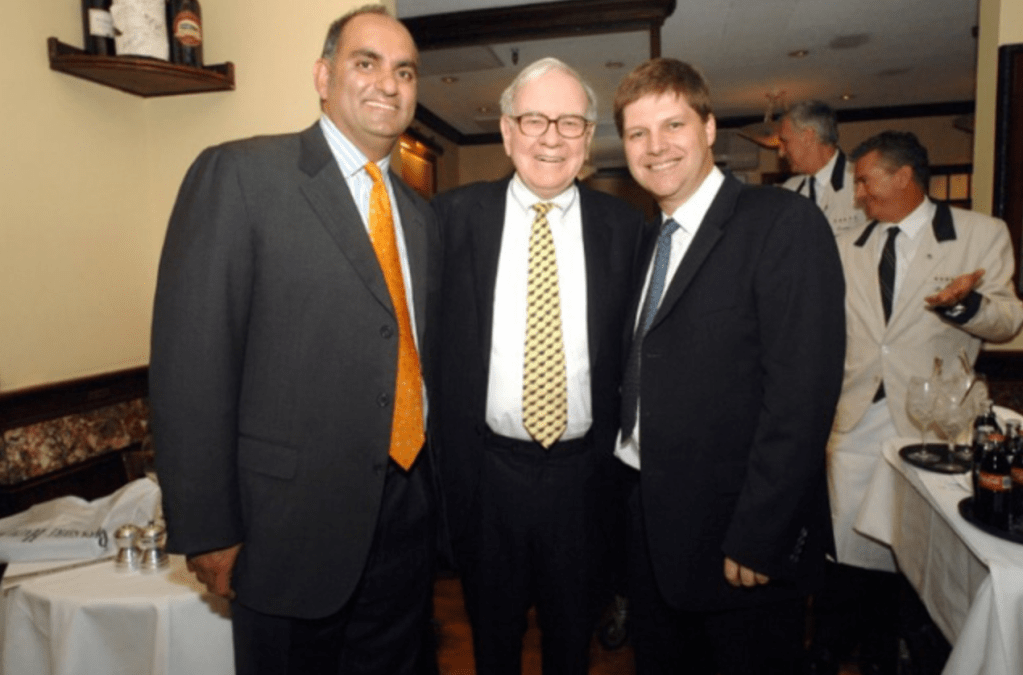

Guy Spier is a Zurich-based investor and founder of Aquamarine Capital, a family office that manages his family’s wealth. Born in 1966 in South Africa, Spier developed an interest in investing at a young age and went on to study economics at Oxford University. After completing his MBA at Harvard Business School, Spier worked at several investment firms before establishing Aquamarine Capital in 1997.

The Value Investing Philosophy

Spier’s investment approach is centered around the principles of value investing, which involves seeking out undervalued companies with strong fundamentals that have the potential to increase in value over time. This strategy requires patience, discipline, and a deep understanding of the companies being invested in.

Spier’s Investment Approach

- Business Quality: Spier looks for companies with strong business models, competitive advantages, and talented management teams.

- Financial Strength: He seeks out companies with solid balance sheets, low debt, and a proven track record of generating cash flow.

- Undervaluation: Spier looks for companies that are trading at a significant discount to their intrinsic value, providing a margin of safety for investors.

- Long-Term Focus: He adopts a long-term perspective, often holding onto investments for five years or more to allow the company’s intrinsic value to be realized.

- Risk Management: Spier emphasizes the importance of managing risk through diversification, position sizing, and a willingness to sell investments that are no longer attractive.

Investment Journey

Spier’s investment journey has not been without its challenges. In his book, he candidly shares his experiences, including his mistakes and successes. Some key takeaways from his journey include:

- The importance of humility: Spier emphasizes the need for investors to remain humble and open to learning from their mistakes.

- The dangers of emotional decision-making: He highlights the importance of separating emotions from investment decisions and adopting a disciplined approach.

- The value of mentorship: Spier credits his mentors, including Warren Buffett and Charlie Munger, with helping him develop his investment philosophy.

The Education of a Value Investor

Guy Spier’s book, The Education of a Value Investor, offers readers an inspiring and deeply personal journey into the mindset and principles that define a successful investor. This book is more than just an investment manual; it’s a candid memoir that blends life lessons with financial wisdom. Spier, influenced by legends like Warren Buffett, provides practical advice on building a disciplined and ethical investment strategy while emphasizing the importance of aligning personal values with professional choices. His insights into overcoming ego and cultivating an environment conducive to sound decision-making resonate far beyond the financial world. Whether you’re new to investing or an experienced professional seeking a fresh perspective, The Education of a Value Investor is a compelling read that challenges you to think holistically about wealth, purpose, and integrity.

Read our review of The Education of a Value Investor.

Final Thoughts on Spier

Guy Spier’s value investing philosophy offers valuable insights for investors seeking to build long-term wealth. By focusing on business quality, financial strength, undervaluation, and risk management, investors can increase their chances of success in the markets. As Spier’s journey demonstrates, investing is a continuous learning process that requires humility, discipline, and patience.

You must be logged in to post a comment.