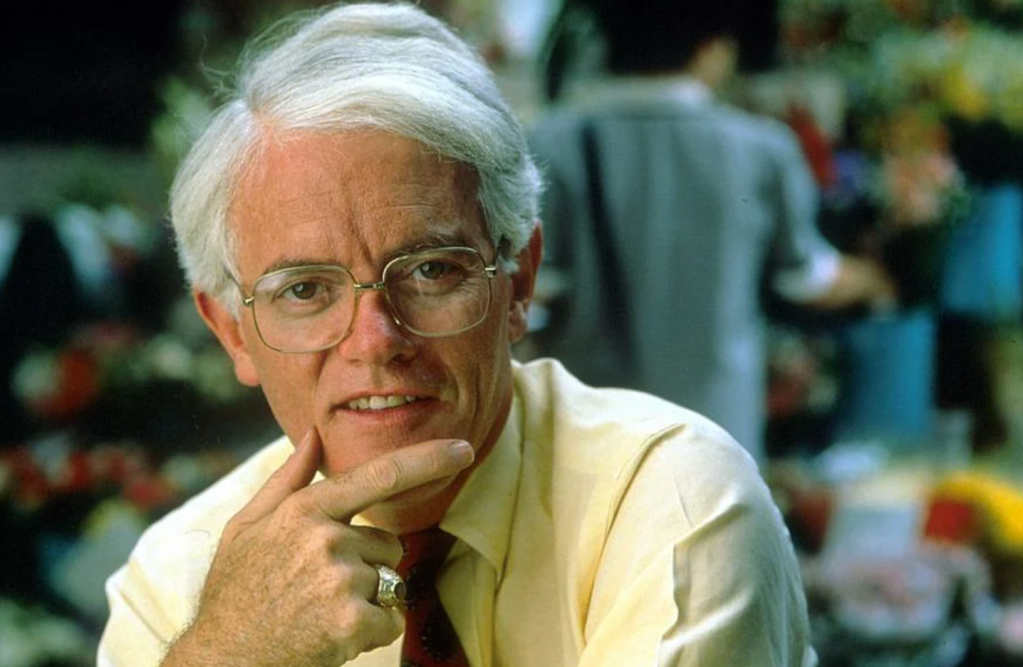

Born in 1944, Peter Lynch is a legendary investor, author, and philanthropist. He graduated from Boston College and later earned his MBA from the Wharton School of the University of Pennsylvania. Lynch began his career in finance at Fidelity Investments in 1966 and took the helm of the Fidelity Magellan Fund in 1977. Under his leadership, the fund grew from $18 million to $14 billion in assets, making it one of the most successful mutual funds of all time.

Lynch’s Investment Philosophy

Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it. – Peter Lynch

Peter Lynch’s investment approach is centered around several key principles:

- Invest in what you know: Lynch advocates for investing in companies and industries you understand. He believes that individual investors have a unique advantage in recognizing emerging trends and opportunities in their areas of expertise.

- Do your research: Lynch stresses the importance of thorough research and due diligence. He recommends analyzing a company’s financials, management team, industry trends, and competitive landscape before making an investment decision.

- Focus on growth: Lynch looks for companies with strong growth potential, driven by factors such as innovative products, expanding markets, or improving profitability.

- Be patient: Lynch emphasizes the importance of long-term investing, encouraging investors to ride out market fluctuations and avoid making impulsive decisions based on short-term volatility.

Lynch’s Investment Strategies

Go for a business that any idiot can run – because sooner or later, any idiot probably is going to run it. – Peter Lynch

Some of Lynch’s most notable investment strategies include:

- GARP (Growth at a Reasonable Price): Lynch seeks companies with strong growth prospects at reasonable valuations. He looks for stocks with a price-to-earnings (P/E) ratio lower than the company’s growth rate.

- The Lynch Formula: Lynch uses a simple formula to estimate a company’s potential return: (Earnings Growth Rate + Dividend Yield) / Price-to-Earnings Ratio. This formula helps him identify undervalued companies with strong growth potential.

- Categorizing Stocks: Lynch categorizes stocks into six groups: slow growers, stalwarts, fast growers, cyclicals, turnarounds, and asset plays. Each category requires a unique investment approach, and Lynch adjusts his strategy accordingly.

Lessons from Peter Lynch

The person that turns over the most rocks wins the game. And that’s always been my philosophy. – Peter Lynch

Peter Lynch’s investment wisdom offers valuable lessons for investors of all levels:

- Stay informed but avoid emotional decisions: Lynch recommends staying up-to-date with market news, but avoiding impulsive decisions based on short-term market fluctuations.

- Diversification is key: Lynch emphasizes the importance of diversifying your portfolio across various asset classes, sectors, and geographies to minimize risk.

- Invest for the long haul: Lynch’s remarkable track record is a testament to the power of long-term investing. He encourages investors to adopt a patient approach, focusing on years rather than months or quarters.

Peter Lynch’s investment philosophy and strategies have stood the test of time, offering valuable insights for investors seeking to build long-term wealth. By adopting a disciplined approach, staying informed, and focusing on growth, investors can increase their chances of success in the markets. As Lynch himself once said, “The key to making money in stocks is not to get scared out of them.”

Books by Lynch

One Up on Wall Street

This book is a classic in the world of investing. Lynch introduces the concept of “buy what you know,” encouraging investors to use their everyday experiences to identify potential stock opportunities. The book explains how individual investors can outperform Wall Street by doing their own research and investing in companies they understand. Lynch demystifies financial jargon, making this a great starting point for beginners.

Beating the Street

In “Beating the Street,” Lynch dives deeper into his investment strategies, sharing how he managed the Magellan Fund and achieved extraordinary success. He outlines his thought process for selecting stocks, building a balanced portfolio, and sticking to his investment principles. The book includes case studies of his past investments, offering practical examples for readers to follow.

Learn to Earn

This book is aimed at beginners and young investors who are new to the stock market. Lynch breaks down the basics of investing, explaining how companies grow, why stock markets exist, and the importance of understanding the economy. “Learn to Earn” serves as an accessible primer for those taking their first steps toward building wealth and achieving financial literacy.

You must be logged in to post a comment.