The Fidelity Magellan Fund is an actively managed equity mutual fund that seeks to provide long-term capital appreciation. The fund’s investment strategy focuses on investing in a diversified portfolio of common stocks, with an emphasis on growth-oriented companies. The fund’s manager employs a bottom-up approach to stock selection, seeking to identify companies with strong growth potential, competitive advantages, and talented management teams.

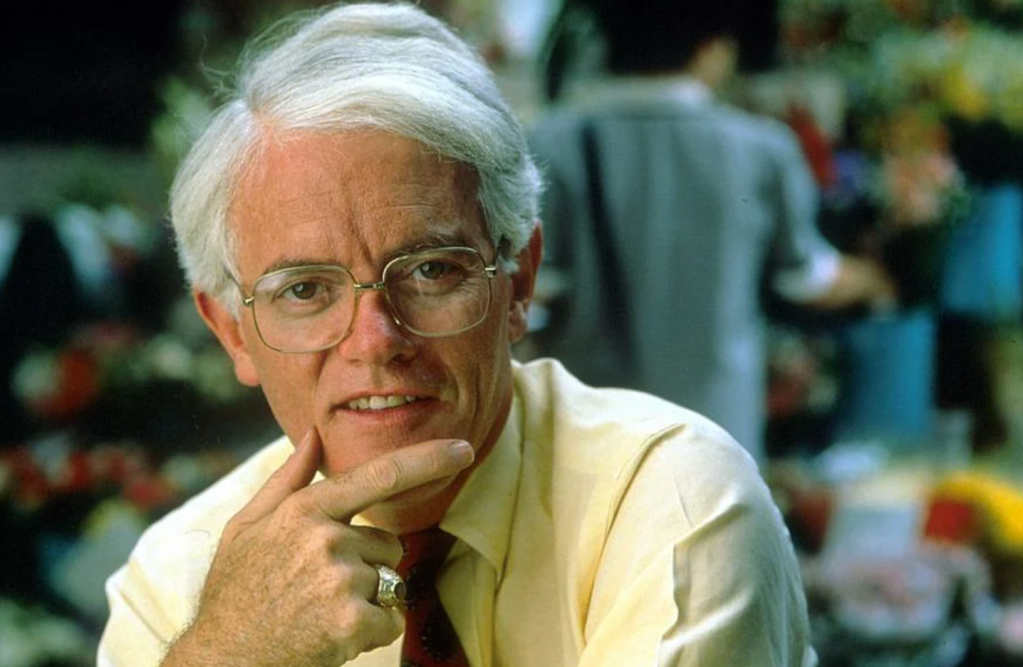

Peter Lynch and the Fidelity Magellan Fund

Peter Lynch is a name synonymous with investment success, thanks to his legendary tenure as the manager of the Fidelity Magellan Fund. Between 1977 and 1990, Lynch transformed the Magellan Fund into one of the most successful mutual funds in history. Under his management, the fund achieved an average annual return of 29.2%, far outpacing the S&P 500’s performance during the same period. By the time he retired in 1990, the Magellan Fund had grown from $18 million in assets to over $14 billion, making it one of the largest mutual funds in the world.

Lynch’s investment philosophy was simple but effective: “Invest in what you know.” He encouraged everyday investors to look for opportunities in their daily lives, such as products or services they regularly used, to identify potential investment winners. This approach, combined with rigorous research and analysis, allowed him to spot high-growth companies early. Lynch’s legacy at the Fidelity Magellan Fund continues to inspire investors today, emphasizing the value of a hands-on, knowledgeable approach to building wealth.

You must be logged in to post a comment.