Money, as we know it, is the cornerstone of modern society. It fuels economies, shapes civilizations, and defines personal aspirations. But where did money come from? Understanding its history can give us deeper insight into its role in our lives today. Let’s take a journey through time to uncover the evolution of money.

Bartering: The Precursor to Money

Before money, there was barter. Ancient civilizations exchanged goods and services directly to fulfill their needs. A farmer might trade grain for a blacksmith’s tools, or a potter might swap clay pots for woven fabrics. While effective in small, close-knit communities, bartering had limitations. It required a “double coincidence of wants,” meaning both parties needed to want what the other offered.

The Birth of Commodity Money

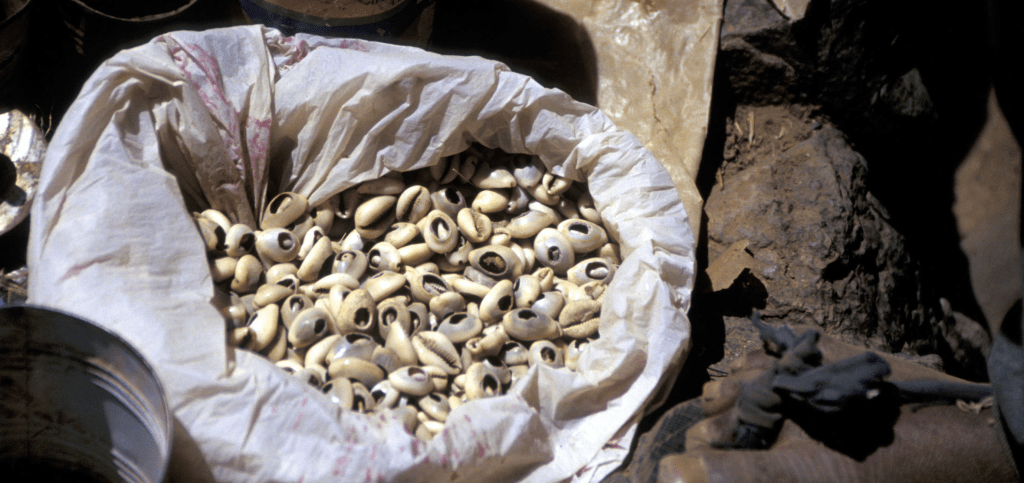

To address the inefficiencies of barter, early societies began using commodity money. These were objects with intrinsic value, such as salt, cattle, or grain. In some cases, seashells or precious stones served as mediums of exchange. Commodity money allowed for easier trade and became widely accepted within communities.

One notable example is the use of cowrie shells in ancient China and Africa. These lightweight, durable shells were easily transportable and recognized for their value, laying the groundwork for more standardized currencies.

Metal Money: The Dawn of Coins

Around 600 BCE, the first metal coins were minted in the ancient kingdom of Lydia (modern-day Turkey). These coins were made from electrum, a naturally occurring alloy of gold and silver. Coins revolutionized trade by being durable, divisible, and universally recognizable within their respective regions.

As civilizations like the Greeks, Romans, and Persians adopted coinage, they began to standardize weights and designs, ensuring trust and acceptance. Coins often featured rulers’ faces or symbols of power, further cementing their credibility.

Paper Money and the Rise of Banking

Metal coins dominated for centuries until the Tang Dynasty in China introduced the first paper money around 700 CE. Lightweight and easy to transport, paper money quickly gained popularity. By the Song Dynasty (960-1279 CE), it became a staple of Chinese commerce.

Europe was slower to adopt paper currency, largely due to skepticism about its value. However, as banking systems developed in the 17th century, institutions like the Bank of England began issuing banknotes backed by gold reserves. This innovation allowed economies to grow without the physical constraints of metal-based money.

The Gold Standard and Fiat Money

By the 19th century, many nations adopted the gold standard, linking their currencies’ value to a fixed quantity of gold. This system provided stability and facilitated international trade but also limited monetary policy flexibility.

The gold standard was abandoned during the 20th century, particularly after World War II, when economies needed more flexibility to recover and grow. Enter fiat money—currency backed by government decree rather than a physical commodity. Today’s dollars, euros, and yen are all fiat currencies, deriving their value from trust in the issuing government.

Digital Money and Cryptocurrency

In recent decades, money has entered the digital realm. Credit cards, online banking, and mobile payment platforms like PayPal and Venmo have transformed how we transact. These innovations offer convenience but also raise questions about security and privacy.

The rise of cryptocurrency is the latest evolution. Bitcoin, introduced in 2009, pioneered decentralized, blockchain-based currency. Cryptocurrencies aim to challenge traditional systems by offering transparency, limited supply, and independence from central authorities. While still emerging, they’ve sparked debates about the future of money.

What Money Means Today

Money has evolved from bartered goods to intangible digital transactions, reflecting society’s changing needs and technologies. Today, it’s more than a medium of exchange—it’s a store of value, a measure of success, and a tool for building the future.

Understanding the history of money reminds us of its adaptability and resilience. Whether you’re budgeting with Simplifi, investing in $VOO, or exploring cryptocurrency, money remains a powerful force that shapes our world and offers opportunities for those who use it wisely.

You must be logged in to post a comment.