If you’re looking to expand your knowledge of investing and gain insights from one of the most successful investors of all time, One Up On Wall Street by Peter Lynch is a must-read. This timeless classic blends practical investment advice with engaging storytelling, making it an excellent resource for anyone looking to better understand how to grow their wealth.

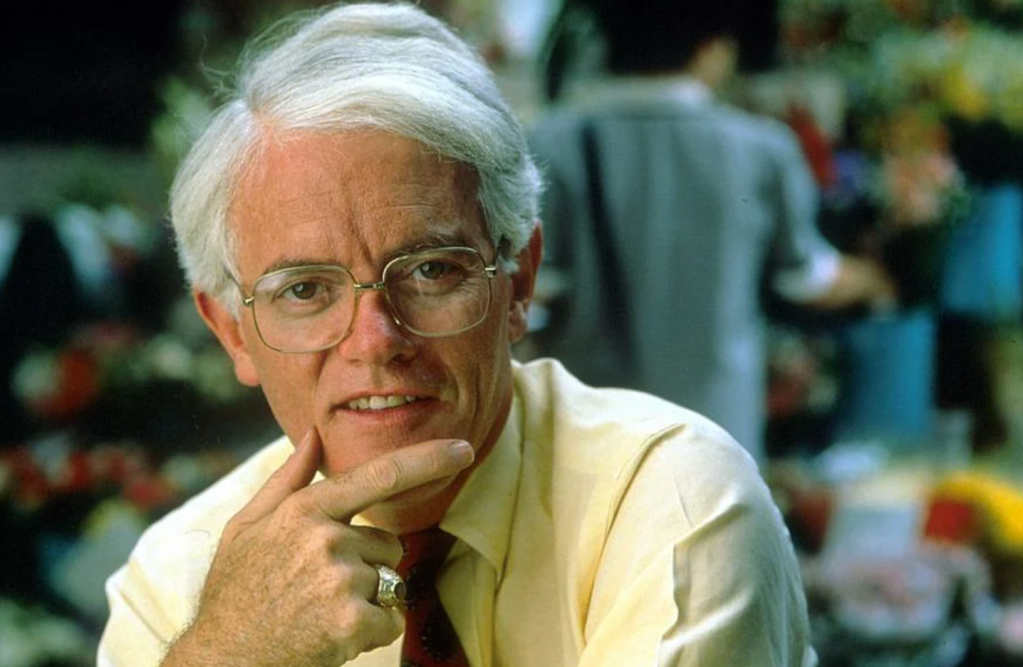

Who is Peter Lynch?

Peter Lynch, who is often compared to Warren Buffett, is one of the most celebrated figures in the investment world. He is best known for his time as the manager of the Fidelity Magellan Fund, a position he held from 1977 to 1990. Under his leadership, the fund’s assets grew from $18 million to $14 billion, achieving an average annual return of 29%. His unparalleled success has made him a household name in finance.

What is the Fidelity Magellan Fund?

The Fidelity Magellan Fund is one of the most famous mutual funds in history, largely due to Peter Lynch’s exceptional performance during his tenure. The fund became synonymous with high returns and innovation, attracting millions of investors who were drawn to Lynch’s ability to identify promising companies before they became household names.

Lynch’s strategy with the fund was unique. He encouraged investors to look at the world around them and use their own experiences to spot trends and opportunities. His philosophy of “buying what you know” helped the Magellan Fund deliver extraordinary returns and solidify its reputation as a top-performing mutual fund.

Key Takeaways

Peter Lynch’s One Up On Wall Street offers a wealth of knowledge for investors at all levels. Here are some of the most important lessons:

Invest in What You Know: Lynch advocates for investing in companies and industries you understand. For example, if you’re a regular customer of a brand that’s consistently growing, that could be a good investment opportunity. You, as a customer, may recognize this company’s growth before a Wall Street investor sitting in their cubicle.

Do Your Research: While investing in what you know is a starting point, Lynch emphasizes the importance of thorough research. This includes analyzing a company’s fundamentals, understanding its competitive advantage, and evaluating its long-term growth potential.

Don’t Follow the Herd: One Up On Wall Street warns against blindly following market trends or media hype. Successful investing often requires going against the crowd and finding value where others aren’t looking.

Patience Pays Off: Investing is a long-term game. Lynch advises investors to avoid short-term thinking and focus on the bigger picture.

Know Your Goals: Not every stock is right for every investor. Lynch stresses the importance of aligning your investments with your financial goals and risk tolerance.

For Beginners and Experienced Investors

The book is a rare gem that appeals to both beginners and experienced investors. For beginners, the book’s straightforward language and relatable examples make complex investment concepts easy to understand. For seasoned investors, Lynch’s anecdotes and strategies provide valuable insights that can refine their approach to stock picking.

Why This Book Matters

The book aligns perfectly with the philosophy of building wealth through smart, long-term investments. Lynch’s emphasis on research, patience, and understanding the market mirrors our recommendations to invest in the S&P 500 and maintain a frugal lifestyle. His advice to avoid market noise and focus on fundamentals complements the disciplined approach we encourage.

Whether you’re just starting your financial journey or looking to take your investing skills to the next level, One Up On Wall Street offers practical wisdom and inspiration. It’s a book that can help you approach investing with confidence and clarity, making it a valuable addition to your personal finance toolkit.

You must be logged in to post a comment.