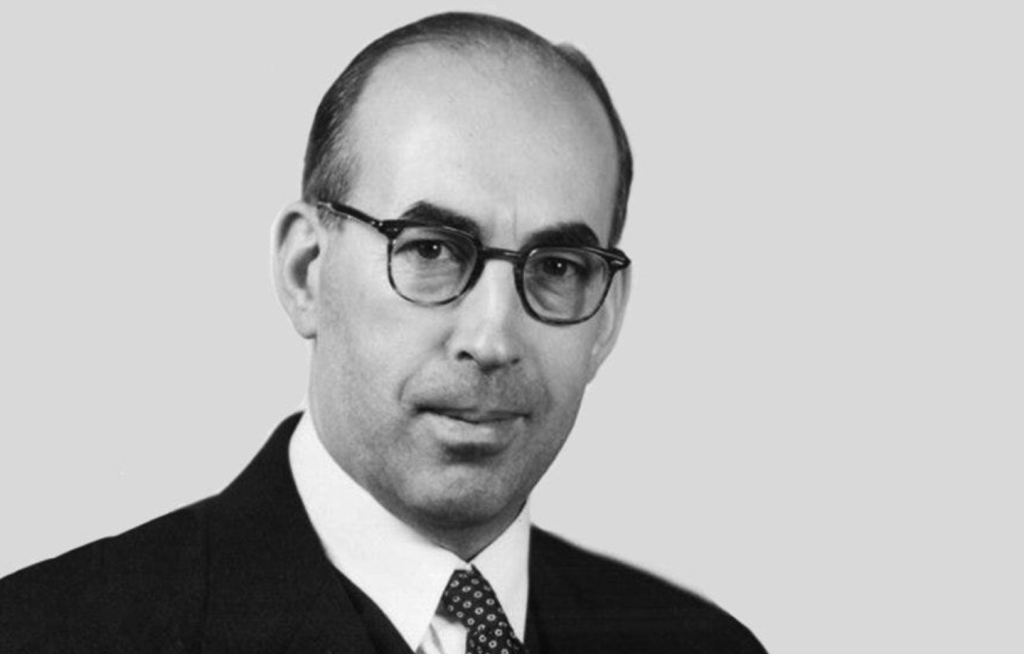

Phil Fisher is widely regarded as one of the most influential investors of the 20th century. Known for his groundbreaking approach to growth investing, Fisher laid the foundation for many of the investment strategies used by successful investors today. His work has earned praise from none other than Warren Buffett, who described Fisher’s book Common Stocks and Uncommon Profits as a key influence on his own investment philosophy.

Biography

Born in 1907, Philip A. Fisher began his career in finance in 1928, attending Stanford University’s Graduate School of Business. After a brief stint in the investment industry, Fisher founded his own firm, Fisher & Company, in 1931, during the Great Depression. Over the decades, Fisher earned a reputation for his exceptional ability to identify companies with strong growth potential and his commitment to long-term investing.

Fisher retired in 1999 at the age of 91, leaving behind a legacy that continues to shape modern investment strategies. He passed away in 2004, but his teachings remain timeless for both individual and institutional investors.

Warren Buffett’s Praise for Fisher

Warren Buffett, one of the most successful investors of all time, has frequently credited Phil Fisher as a major influence on his own investing style. While Buffett’s early approach was heavily inspired by Benjamin Graham’s value investing principles, Fisher introduced him to the idea of evaluating a company’s growth potential and management quality—concepts that Buffett integrated into his own methodology. This blend of value and growth investing has helped Buffett achieve extraordinary success.

Fisher’s Financial Expertise

Phil Fisher pioneered what is now referred to as “scuttlebutt research,” a method of gathering insights about a company by speaking with customers, employees, suppliers, and industry experts. This qualitative approach helped Fisher uncover valuable information that wasn’t always evident in financial statements. His focus on innovation, competitive advantage, and management integrity made him a true visionary in the investment world.

Key principles of Fisher’s investment strategy include:

- Investing in innovative companies: Fisher believed in identifying companies with products or services that stood out in their industry.

- Evaluating management quality: He emphasized the importance of trustworthy and competent leadership.

- Long-term perspective: Fisher encouraged holding onto investments for the long haul, allowing compounding to work its magic.

What Can We Learn from Fisher?

Phil Fisher’s investment philosophy offers valuable insights for readers of Winchell House who are embarking on their financial journey:

- Research is key: Before investing in stocks, take the time to understand the company’s business model, competitive advantage, and management quality.

- Think long-term: Avoid trying to time the market and instead focus on holding investments for years, even decades.

- Diversify wisely: While Fisher was known for concentrated portfolios, newer investors might prefer a diversified approach, such as investing in the S&P 500 via $VOO, to spread risk.

Books by Fisher

Phil Fisher authored several influential books, including:

- Common Stocks and Uncommon Profits: This classic remains a must-read for investors. It introduced the concept of scuttlebutt research and emphasized the importance of growth investing.

- Paths to Wealth Through Common Stocks: This book expands on Fisher’s investment strategies and provides additional insights into building long-term wealth.

- Conservative Investors Sleep Well: In this book, Fisher explores risk management and how to invest in a way that minimizes anxiety.

Similar Personal Finance Figures

If you’re interested in Phil Fisher’s work, you might also want to explore the teachings of these influential figures:

- Warren Buffett: Often seen as a blend of Benjamin Graham and Phil Fisher’s philosophies, Buffett’s strategies focus on value and growth investing.

- Benjamin Graham: Known as the father of value investing, Graham’s teachings on analyzing financial statements complement Fisher’s qualitative approach.

- Peter Lynch: Lynch’s approach to investing in companies you understand aligns well with Fisher’s principles.

Final Thoughts

Phil Fisher’s legacy as a pioneer of growth investing continues to inspire investors around the world. His focus on thorough research, innovation, and long-term thinking offers a roadmap for achieving financial success. By learning from his principles and incorporating them into your own financial strategy, you can take significant steps toward building wealth and financial independence.

You must be logged in to post a comment.