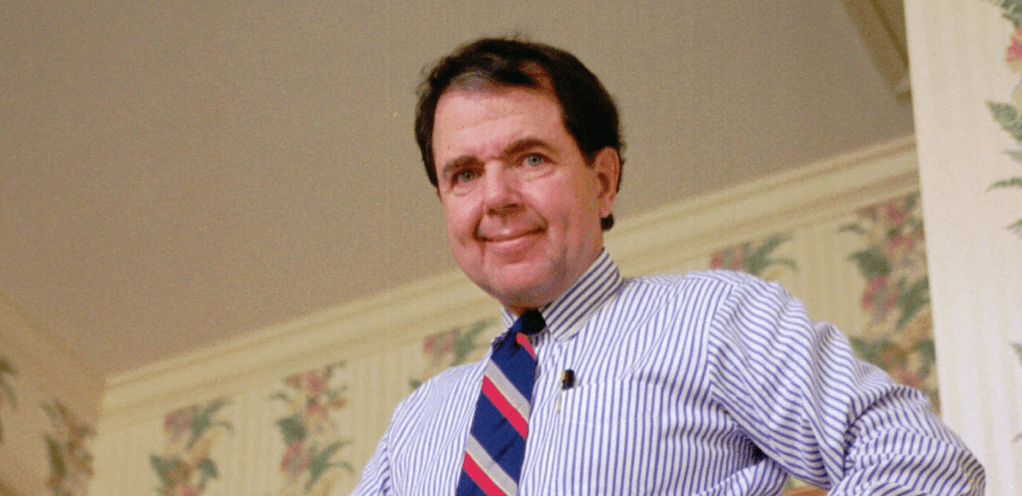

Thomas J. Stanley was an American author, researcher, and financial expert best known for his work in studying the habits and characteristics of affluent individuals. His groundbreaking insights have shaped the understanding of wealth-building and financial independence for millions of readers.

Biography of Thomas J. Stanley

Born on April 7, 1944, in the Bronx, New York, Thomas J. Stanley pursued higher education with a focus on marketing and business. He earned a Bachelor’s degree from Georgia State University, a Master’s degree from the University of Tennessee, and a Ph.D. in Business Administration from the University of Georgia.

Stanley’s professional career included working as a professor of marketing at Georgia State University and a consultant for various corporations and institutions. His academic background and interest in consumer behavior led him to explore the financial habits of America’s wealthy, which became the foundation of his research and writing career.

Tragically, Stanley passed away on February 28, 2015, in a car accident. However, his legacy lives on through his influential books and the principles he shared with the world.

Financial Expertise and Research

Thomas J. Stanley’s expertise lies in his extensive research on affluent individuals in the United States. He conducted surveys and interviews with thousands of high-net-worth individuals to uncover common behaviors, habits, and attitudes that contributed to their financial success.

One of Stanley’s key findings was that wealth accumulation is often tied to discipline, frugality, and long-term planning rather than flashy lifestyles or high incomes. He emphasized that many millionaires achieve financial independence by living below their means, investing wisely, and prioritizing financial security over conspicuous consumption.

What Can We Learn From Stanley?

Readers of Winchell House can learn several valuable lessons from Thomas J. Stanley:

- Live Below Your Means: Wealth is often built by spending less than you earn and avoiding unnecessary expenses.

- Focus on Accumulating Assets: Invest in appreciating assets, such as the S&P 500 index funds like $VOO, to grow your wealth over time.

- Avoid Lifestyle Inflation: Resist the urge to increase your spending as your income grows.

- Prioritize Financial Independence: Set long-term goals to achieve financial independence and reduce reliance on employment income.

- Practice Frugality: Being frugal doesn’t mean deprivation; it means making intentional choices that align with your financial goals.

Books by Stanley

Stanley authored several bestselling books that have become classics in the personal finance space:

- The Millionaire Next Door (1996): Co-written with William D. Danko, this book reveals the surprising habits of America’s wealthy and dispels myths about how wealth is accumulated. Read our full review.

- The Millionaire Mind (2000): A follow-up that dives deeper into the mindset and values of millionaires, highlighting traits like resilience, hard work, and a focus on education.

- Stop Acting Rich (2009): This book challenges the notion of luxury spending and emphasizes the importance of financial prudence.

Similar Personal Finance Figures

If you’re interested in the teachings of Thomas J. Stanley, you might also find inspiration in the work of these personal finance experts:

- Dave Ramsey: Known for his baby steps approach to getting out of debt and building wealth.

- Vicki Robin: Co-author of Your Money or Your Life, a guide to achieving financial independence through mindful spending.

- J.L. Collins: Author of The Simple Path to Wealth, which focuses on the power of investing in index funds.

- Mr. Money Mustache: A popular blogger who promotes frugality and early retirement through financial independence.

Final Thoughts

Thomas J. Stanley’s research and writing have left an indelible mark on the world of personal finance. His principles of frugality, disciplined investing, and living below your means align perfectly with the values of Winchell House. By applying these lessons, readers can take meaningful steps toward achieving financial independence and building a secure future.

You must be logged in to post a comment.