The relationship between U.S. presidents and the stock market is a topic of intrigue for many investors. Questions like, “Does the stock market perform better under Republicans or Democrats?” or “Should I adjust my portfolio when a new president is elected?” are common questions.

Let’s take a closer look at how presidential administrations have historically influenced the stock market and why staying invested in the S&P 500 for the long term is a smart strategy.

The Stock Market Under Different Presidents

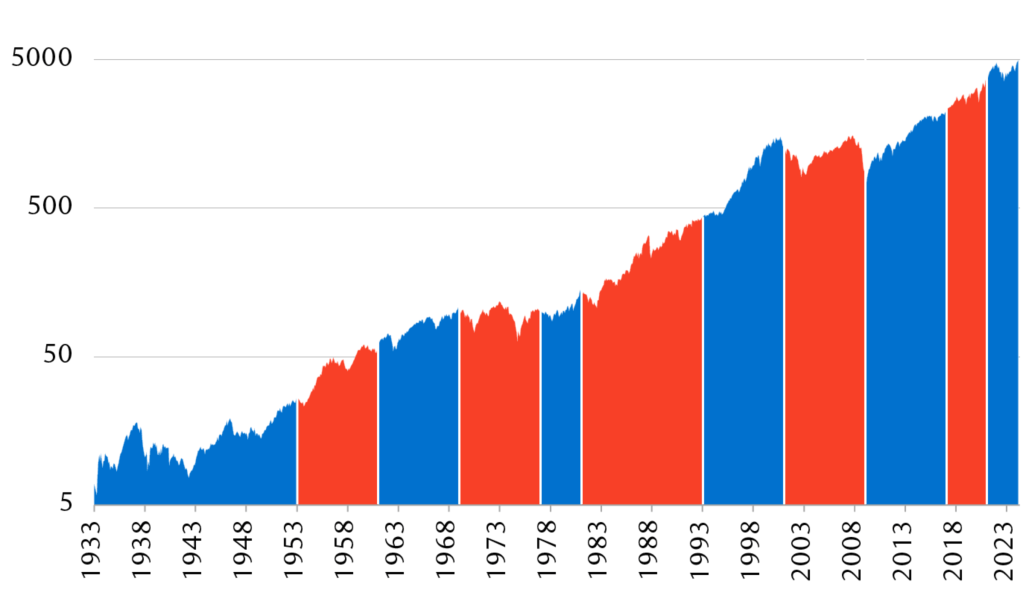

Historically, the stock market has experienced growth regardless of which political party controls the White House. While certain policies and events tied to individual presidents may influence short-term market movements, the long-term trajectory of the stock market has consistently trended upward.

For instance, Franklin D. Roosevelt oversaw market recovery during the Great Depression, and Ronald Reagan’s administration saw significant growth during the 1980s. In more recent decades, both Bill Clinton and Barack Obama presided over strong bull markets, while Donald Trump saw record highs prior to the COVID-19 pandemic. Joe Biden’s presidency has also seen market volatility, largely due to inflation and Federal Reserve actions, but the market’s long-term potential remains intact.

Does Political Party Matter for Stock Market Performance?

When analyzing available data, there is no definitive evidence to suggest that the market performs significantly better under either Republicans or Democrats. According to historical averages, the S&P 500 has grown during both Democratic and Republican administrations.

Some key trends include:

- Republican Presidents: Often associated with tax cuts and deregulation, which can benefit corporations and spur market growth.

- Democratic Presidents: Known for policies focusing on infrastructure and social programs, which can boost economic activity.

It is worth noting that external factors—such as economic cycles, global events, and Federal Reserve policy—often have a more significant impact on the market than the president’s political affiliation.

The S&P 500’s Performance Over the Decades

The S&P 500, an index representing 500 of the largest publicly traded companies in the U.S., has delivered an average annual return of around 10% since its inception in 1957. This growth has occurred through wars, recessions, pandemics, and changing administrations.

Why Long-Term Investing in the S&P 500 Makes Sense

Rather than trying to predict how the stock market will react to a new president or specific policies, a better strategy is to focus on long-term investing. By holding an index fund like the S&P 500 ETF ($VOO) for 10 years or more, you can benefit from the compounding growth of the market.

Key Benefits of Long-Term Investing:

- Resilience: The market recovers from downturns over time.

- Diversification: The S&P 500 includes companies across all sectors of the economy.

- Lower Risk of Timing Mistakes: Attempting to time the market often results in missed opportunities for growth.

A Proven Strategy: Stay Invested

Regardless of who is in office, the stock market has shown a remarkable ability to grow over time. While short-term volatility may occur, history shows that staying the course and investing in the S&P 500 is a winning strategy. By living a frugal lifestyle, contributing to your investments consistently, and avoiding reactionary decisions based on politics, you can set yourself up for financial success.

We recommend prioritizing long-term growth by investing in the S&P 500, maintaining a high-yield savings account for short-term needs, and staying informed through budgeting tools like Simplifi.

By focusing on your financial goals rather than political noise, you can achieve financial independence and peace of mind.

You must be logged in to post a comment.