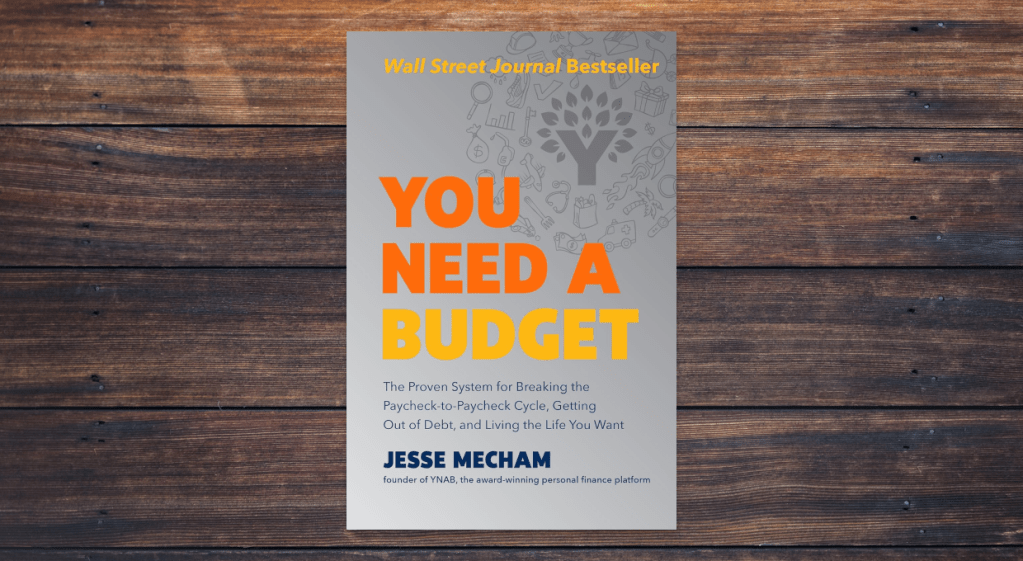

If you’re beginning your journey toward financial independence and searching for practical budgeting advice, You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse Mecham might be just what you need. At Winchell House, we believe in a frugal lifestyle and smart money management. This book review will explore Mecham’s background, key personal finance lessons from the book, some criticisms, and similar reads that can help you tackle credit card debt and optimize your budget.

Who is Jesse Mecham?

Jesse Mecham is the creator behind the popular budgeting software and methodology known as You Need a Budget (YNAB). With a passion for helping others take control of their finances, Mecham developed a system that emphasizes proactive planning and disciplined spending. His approach resonates with many Americans looking to break free from the paycheck-to-paycheck cycle and move toward true financial independence. Mecham’s work aligns well with the advice we share at Winchell House, such as using budgeting apps to monitor spending and prioritizing home ownership over renting.

Lessons from the Book

One of the strongest aspects of You Need a Budget is its actionable, no-nonsense approach to managing money. Here are some key takeaways:

- Every Dollar Has a Job: The book teaches you to assign every dollar a purpose, which is essential for sticking to a budget and avoiding unnecessary expenses.

- Plan for Future Expenses: Mecham encourages readers to anticipate irregular costs, helping you avoid falling into the trap of credit card debt.

- Flexibility in Budgeting: While the system is structured, it also allows for adjustments as your financial situation evolves, ensuring you can stay on track even when unexpected expenses arise.

- Building a Nest Egg: By controlling your spending, you can free up excess money to invest in high-yield savings accounts, short-term treasury bills, or even your S&P 500 nest egg.

- Reducing Financial Stress: Following this method can reduce reliance on a financial advisor for everyday money management, empowering you to make smarter decisions independently.

Criticisms of The Book

While many readers praise You Need a Budget for its simplicity and effectiveness, there are a few criticisms to consider:

- Learning Curve: Some users find the initial setup and discipline required by the system to be challenging. It might feel overwhelming if you’re new to structured budgeting.

- Over-Reliance on the Software: Critics point out that the book’s philosophy is closely tied to the YNAB software. This could be a downside if you prefer a more manual or alternative digital budgeting method.

- Not a One-Size-Fits-All Solution: Although You Need a Budget offers a solid foundation for budgeting, its rigid structure might not suit everyone’s financial situation, particularly those with irregular incomes or unique expenses.

Final Thoughts

You Need a Budget offers a refreshing take on managing your money with discipline and purpose—a must-read for anyone looking to break free from financial stress and gain control over their budget. While the book has its criticisms, its practical advice on eliminating credit card debt and planning for future expenses is invaluable for those starting their financial journey.

Whether you’re a budgeting novice or a seasoned saver, Jesse Mecham’s system provides the tools you need to build a secure financial future.

You must be logged in to post a comment.