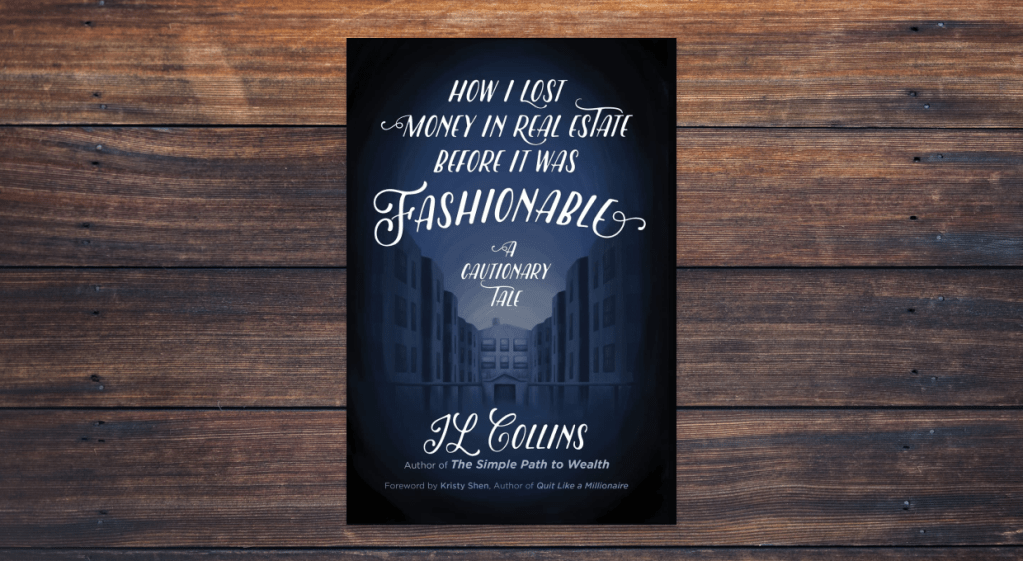

In the world of personal finance, cautionary tales can be as enlightening as success stories. How I Lost Money in Real Estate Before It Was Fashionable: A Cautionary Tale by JL Collins offers readers an honest account of missteps in the real estate market—a must-read for anyone on the journey toward financial independence. This book review explores the insights JL Collins provides, the key lessons for real estate investing, and a few criticisms that can help you better understand where this advice fits into your overall financial strategy.

Who is JL Collins?

JL Collins (aka JLCollinsnh) is a well-respected voice in the personal finance community, best known for his influential work, The Simple Path to Wealth. With decades of experience and a clear, approachable style, Collins has helped countless readers learn how to build wealth through smart investing and frugal living. Although his primary focus has been on the S&P 500 and long-term stock market strategies, in this cautionary tale he turns his attention to real estate investing—illustrating that even experienced investors can face setbacks. His straightforward advice is complemented by a strong emphasis on maintaining a solid budget, avoiding unnecessary credit card debt, and seeking guidance from a trusted financial advisor when needed.

Real Estate Investing Lessons

Collins’ narrative serves as a reminder that every investment comes with its own set of risks. One of the main lessons from the book is the importance of not over-leveraging yourself. Real estate can be tempting, especially when market trends are hot, but without careful analysis and proper budgeting, it’s easy to fall into traps that lead to financial strain.

Key takeaways include:

- Risk Management: Understanding market cycles and knowing when to step back can save you from significant losses.

- Diversification: Instead of putting all your eggs in one basket, consider balancing your portfolio with a mix of assets—like a high-yield savings account, short-term treasury bills, and a steady S&P 500 nest egg.

- Real Estate vs. Other Investments: While owning your home can be a solid long-term investment, renting and channeling extra money into diversified assets might be a smarter move for some, especially when weighed against the potential pitfalls of a volatile real estate market.

- Prudent Budgeting: Using popular budgeting apps to track spending and avoid the lure of credit card debt is essential. Collins’ experiences underscore that financial discipline is key to long-term success, whether you’re investing in property or stocks.

Criticisms of the Book

Despite its engaging narrative and practical lessons, the book is not without its criticisms. Some readers have noted that:

- Anecdotal Focus: The personal anecdotes, while vivid and instructive, sometimes overshadow broader strategies that could benefit a wider audience.

- Limited Actionable Steps: For beginners, the book may not provide enough step-by-step guidance on how to avoid similar pitfalls in today’s dynamic market.

- Niche Perspective: Given Collins’ background and expertise in stock market investing, his real estate advice might seem less comprehensive compared to dedicated real estate investing guides.

These criticisms serve as a reminder that while cautionary tales are valuable, it’s important to supplement them with additional research and advice from a professional financial advisor.

Final Thoughts

How I Lost Money in Real Estate Before It Was Fashionable serves as a valuable lesson for anyone embarking on their financial journey. JL Collins’ honest recounting of his mistakes reinforces the importance of cautious, well-researched investing—whether you’re considering real estate or focusing on building an S&P 500 portfolio.

The book encourages readers to live frugally, budget wisely, and prioritize financial independence over quick gains. While it may not provide every answer, it’s a powerful reminder that learning from failure is just as crucial as celebrating success. Use these insights to refine your strategy, avoid unnecessary pitfalls, and continue building a robust financial future.

You must be logged in to post a comment.