Common Stocks and Uncommon Profits and Other Writings by Phil Fisher is a classic in the investment world and a must-read for anyone embarking on a journey toward financial independence. This review will provide a brief introduction to the book, explore who Phil Fisher was, highlight key investing lessons from the book, discuss some criticisms, and suggest similar reads for those eager to expand their financial knowledge.

Originally published decades ago, this book remains relevant by offering timeless insights into investing. Fisher’s approach emphasizes qualitative analysis, encouraging readers to look beyond mere numbers and focus on the underlying business quality and long-term growth potential. In an era where many investors focus solely on metrics and technical analysis, Fisher’s work reminds us of the importance of understanding a company’s story.

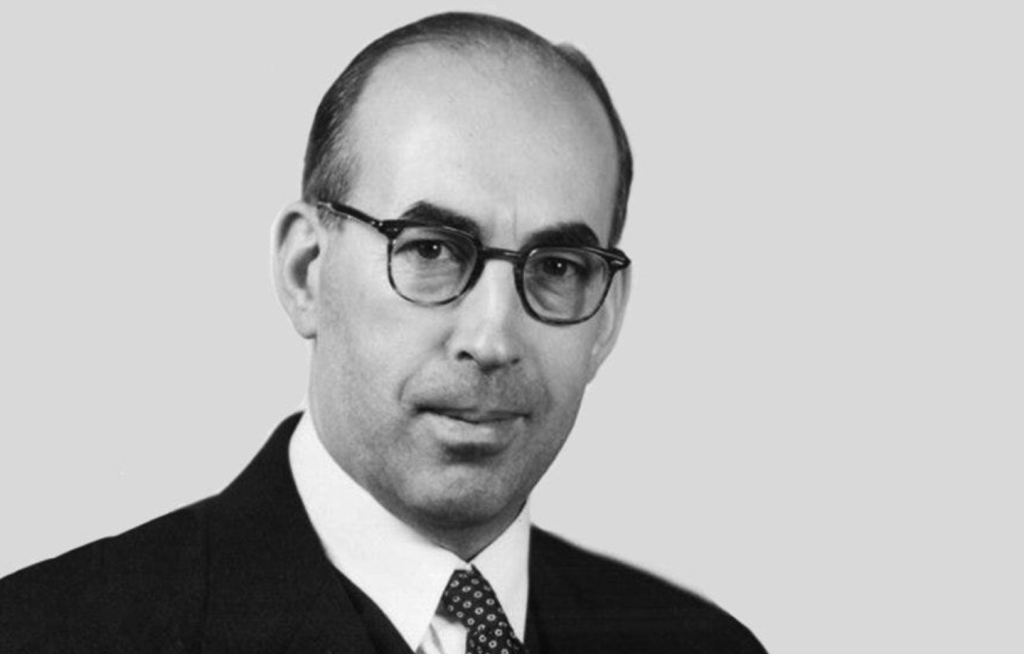

Who is Phil Fisher?

Phil Fisher was a pioneer in the field of growth investing. With a career that spanned several decades, Fisher was known for his deep-dive research and his ability to identify companies with exceptional potential.

His methods have influenced generations of investors, including those who advocate for a balanced financial approach, combining a strict budget with wise investment choices, such as diversifying with high-yield savings accounts, short-term treasury bills, and even a robust S&P 500 nest egg. Fisher’s legacy endures as a guiding light for anyone looking to build wealth while maintaining financial discipline.

Investing Lessons

One of the standout lessons from Fisher’s work is the emphasis on thorough research and understanding a business before investing.

Here are a few key takeaways:

- Qualitative Analysis: Common Stocks advises investors to assess a company’s management quality, competitive advantages, and innovation potential. This approach can help mitigate risks like unexpected credit card debt or mismanaged funds that often derail financial planning.

- Long-Term Perspective: Instead of chasing short-term gains, Fisher champions a long-term vision, echoing the benefits of investing in steady performers like the S&P 500.

- Holistic Evaluation: Beyond the balance sheet, investors are encouraged to consider factors such as industry trends, consumer behavior, and even company culture. This comprehensive outlook can be invaluable when consulting with a financial advisor or planning your personal budget.

Criticisms of the Book

Despite its influential status, Common Stocks is not without its critiques:

- Outdated Examples: Some readers find that certain case studies and examples no longer resonate with today’s market conditions. The investment landscape has evolved with technology and globalization, which can make some of Fisher’s insights feel a bit dated.

- Qualitative Over Quantitative: Fisher’s strong focus on qualitative analysis may leave some investors wishing for a more balanced approach that incorporates modern quantitative tools. While his philosophy is foundational, integrating his methods with contemporary data analysis can provide a more rounded strategy.

- Complexity for Beginners: For those just starting out, the depth of Fisher’s research methods may seem overwhelming.However, many still find value in adapting his principles to fit modern investing strategies, whether you’re managing a tight budget or planning for long-term financial independence.

Final Thoughts

Common Stocks and Uncommon Profits and Other Writings continues to be a valuable resource for anyone interested in starting their financial journey. Whether you’re looking to build a nest egg with investments in the S&P 500, maintain a strict budget to avoid pitfalls like excessive credit card debt, or simply learn from one of the great minds in investing, Fisher’s insights offer timeless advice.

Common Stocks encourages a balanced approach: one that emphasizes research, long-term planning, and a commitment to financial discipline. As you chart your course toward financial independence, consider this book a trusted companion, and don’t hesitate to seek advice from a financial advisor to tailor these timeless strategies to your personal situation.

You must be logged in to post a comment.