Personal finance can feel overwhelming, but Get Good with Money by Tiffany Aliche provides a step-by-step guide to achieving what she calls “financial wholeness.” Unlike traditional financial independence books that emphasize early retirement, Aliche focuses on practical strategies that help readers build a stable and secure financial foundation. This book is ideal for beginners looking for a straightforward roadmap to managing money effectively and developing lasting financial habits.

Who is Tiffany Aliche?

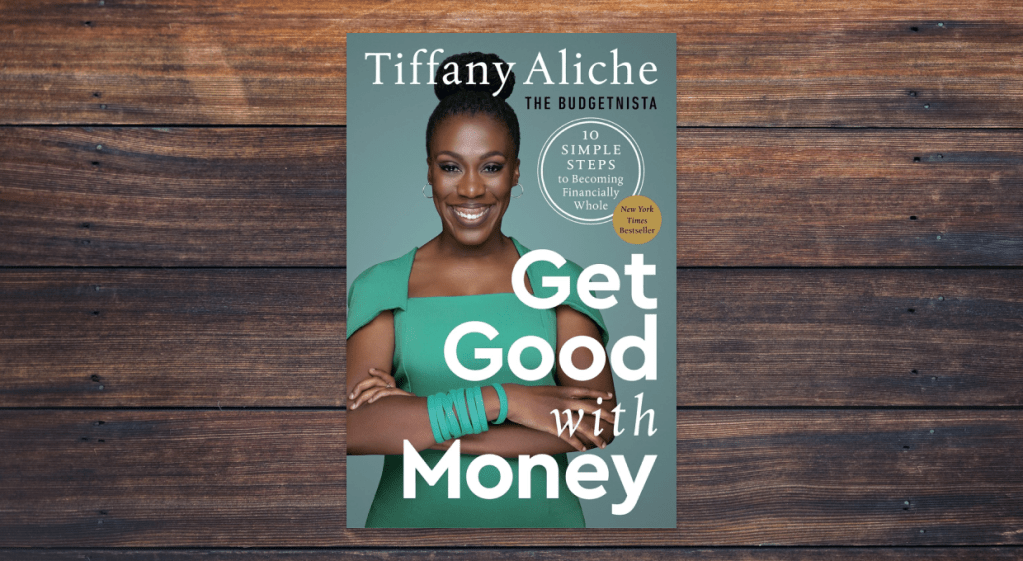

Tiffany Aliche, also known as “The Budgetnista,” is a financial educator and former teacher with a passion for helping people take control of their finances. After experiencing personal financial hardship, she turned her struggles into a mission to educate others about budgeting, saving, and wealth-building. Aliche has been featured on major media outlets like Good Morning America and The New York Times, and she has built a loyal following through her online financial education programs.

Lessons from Get Good with Money

Aliche introduces readers to the concept of financial wholeness, which consists of ten core elements, including budgeting, saving, debt management, investing, credit building, insurance, and estate planning. Some key lessons from the book include:

- Creating a Budget That Works: Aliche emphasizes the importance of tracking expenses, using budgeting apps, and setting realistic financial goals.

- Eliminating Credit Card Debt: Get Good with Money provides practical strategies to pay off debt systematically and avoid falling back into financial traps.

- Building an Emergency Fund: Aliche encourages readers to keep at least three to six months’ worth of living expenses in a high-yield savings account.

- Investing for the Future: She highlights the power of compound interest and recommends investing in index funds like the S&P 500 to build long-term wealth.

- Understanding Insurance and Estate Planning: Aliche stresses the importance of life insurance, wills, and other essential financial protections that many people overlook.

Criticisms of the Book

While Get Good with Money offers a solid foundation for financial literacy, some readers may find the advice too basic, particularly those already familiar with personal finance concepts. Additionally, Aliche’s approach is heavily focused on mindset and motivation, which might not resonate with those looking for a more numbers-driven, analytical strategy. Lastly, some critics argue that the book could offer more detailed investment advice beyond general recommendations.

Final Thoughts

Get Good with Money is an excellent starting point for anyone new to personal finance or struggling to gain control over their money. Tiffany Aliche provides a clear, actionable plan to achieve financial wholeness, making complex financial concepts accessible to a wide audience.

While it may not be the best fit for seasoned investors, beginners looking for a motivational and practical guide will find tremendous value in this book. If you’re on the path to financial independence, this book can serve as a useful stepping stone toward a more secure financial future.

You must be logged in to post a comment.