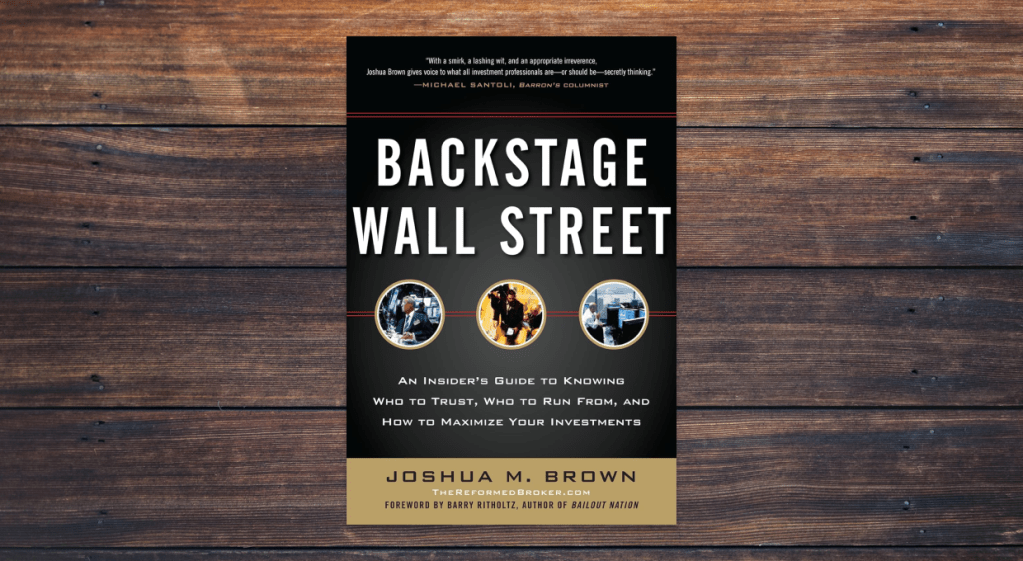

Backstage Wall Street by Josh Brown is a behind-the-scenes look at the financial industry, told with unflinching honesty and a sharp sense of humor. Unlike many finance books that focus on building wealth through personal discipline or historical data, this book lifts the curtain on the inner workings of brokerage firms, financial advisors, and Wall Street sales culture.

It’s part memoir, part exposé, and part wake-up call for individual investors who assume everyone in the finance world has their best interests in mind.

Backstage Wall Street is not a step-by-step guide to investing, but rather a cautionary tale about how the industry often works against everyday investors. It’s a valuable read for anyone trying to understand how the financial sausage gets made.

Who Is Josh Brown?

Josh Brown, also known as “The Reformed Broker,” is a former financial advisor who now runs his own investment advisory firm, Ritholtz Wealth Management. He’s a regular commentator on CNBC, widely followed on social media, and known for his straight-talking style and skepticism of industry hype.

Before becoming an advocate for transparency in investing, Brown spent years working inside Wall Street brokerage firms. His first-hand experience gives the book its unique tone: part insider confessional, part investor education.

Lessons Readers Can Take Away

Financial advisors are not all created equal

One of the biggest takeaways is that many advisors don’t work for their clients—they work for their firm’s sales targets. Brown explains the difference between fiduciary advisors (who must act in your best interest) and commission-based brokers (who often don’t).

Your ignorance is their opportunity

The financial industry profits from investor confusion. Brown outlines how complex products are marketed to retail investors who don’t fully understand the risks. If something sounds too good to be true, it probably is.

Being skeptical is healthy

Backstage Wall Street encourages readers to think critically about where they get financial advice and whether those sources have conflicts of interest. This is a good reminder to learn about money yourself instead of blindly trusting someone else.

Sales culture trumps client outcomes

Many firms train new advisors in high-pressure sales tactics instead of investment strategy. Brown shows how this leads to churn-and-burn behavior, where clients are sold whatever products will generate the most fees.

You are your own best advocate

Ultimately, Brown argues that individuals must take responsibility for learning the basics of investing and personal finance. A good starting point is reading books on money, using budgeting apps, and sticking to long-term strategies like investing in the S&P 500.

Criticisms of the Book

While Backstage Wall Street is highly entertaining and informative, it’s not without its drawbacks:

Tone can be cynical

Some readers may find Brown’s tone overly jaded or sarcastic. The book paints a grim picture of Wall Street, which could discourage new investors rather than empower them.

Limited actionable advice

The book does a great job of warning readers about what not to do, but it doesn’t offer a clear blueprint for what to do instead. Readers looking for a step-by-step plan for financial freedom may want to supplement it with other books.

Anecdotal focus

Much of Backstage Wall Street is based on Brown’s personal experience, which, while compelling, may not represent every advisor or firm. Not all parts of the financial industry operate in the same way.

Why This Book?

Backstage Wall Street is worth reading because it fills a gap in financial education. Many personal finance books teach you how to budget, save, and invest—but few teach you how to protect yourself from bad advice. This book does.

For readers who are focused on frugal living, investing in the S&P 500, and learning how money works, this book serves as a sharp reminder to stay vigilant. Understanding the motivations of financial advisors, brokerages, and salespeople is just as important as knowing which index fund to buy.

Final Thoughts

If you’ve ever wondered what really goes on in financial firms behind closed doors, Backstage Wall Street offers a compelling and often shocking answer. It’s a fast-paced, eye-opening read that will make you think twice before blindly following a financial advisor’s recommendations.

While it may not be a how-to guide, the book reinforces a message we believe in strongly: educate yourself, stay skeptical, and keep your money strategies simple and aligned with your long-term goals. Read books on money. Use budgeting apps. Invest in the S&P 500. And most importantly, don’t let someone else’s incentives dictate your financial future.

You must be logged in to post a comment.