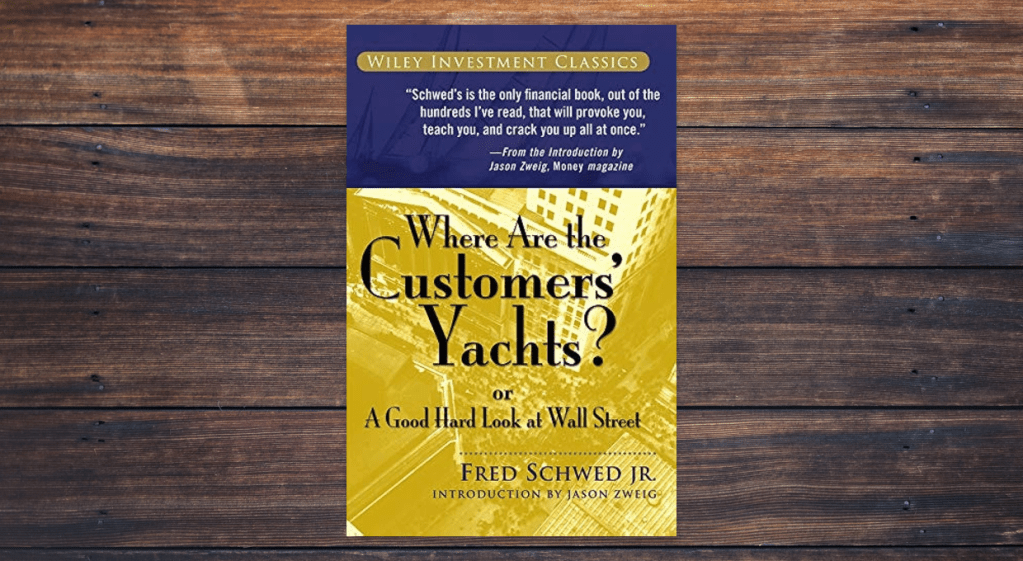

Fred Schwed’s Where Are the Customers’ Yachts? is a timeless and satirical take on Wall Street, investing, and the financial industry’s priorities.

First published in 1940, the book continues to resonate today because of its sharp wit and brutal honesty. For anyone looking to learn more about money, financial advisors, or the psychology behind investing, this classic remains surprisingly relevant.

Who was Fred Schwed?

Fred Schwed Jr. was a professional trader who, like many, saw his fortune evaporate in the stock market crash of 1929. After leaving Wall Street, he turned to writing and used his firsthand experience to shine a light on the inner workings of the financial world. Schwed’s unique blend of humor and insight made Where Are the Customers’ Yachts? one of the earliest and most influential books on money, particularly in how it exposes the contradictions of Wall Street culture.

Key Lessons from the Book

Financial professionals are not always on your side

Schwed famously critiques the financial services industry for enriching itself while often leaving clients with poor results. The book’s title refers to a real-life incident where a visitor to New York, after seeing the lavish yachts owned by stockbrokers and bankers, asked, “Where are the customers’ yachts?” The point: financial advisors often make money regardless of whether their clients do.

Markets are unpredictable

Schwed emphasizes that even the experts can’t reliably predict market movements. His advice is to be skeptical of anyone who claims to have a system or secret to beating the market. This aligns with modern investing wisdom that recommends simple, long-term strategies over market timing or chasing trends.

Psychology plays a major role in investing

Throughout the book, Schwed highlights the emotional side of money decisions. Fear, greed, overconfidence, and herd behavior are timeless obstacles for investors. Readers learn that controlling your psychology is just as important as knowing the numbers.

Complexity is often unnecessary

Where Are the Customers’ Yachts? shows that the world of finance is intentionally complicated to create dependency on advisors and services. In reality, sound investing can be simple—save consistently, invest in broad index funds like the S&P 500, and avoid unnecessary trading.

Criticisms of the Book

While widely praised, the book isn’t without its drawbacks. One common criticism is that some of the humor and references feel outdated, especially for readers unfamiliar with the financial culture of the early 20th century. Additionally, the book lacks practical, step-by-step financial advice. It’s more about attitude and perspective than tactics.

However, this can also be a strength. The book doesn’t try to be a how-to guide—it’s more of a guide on how to think about money, investing, and the financial industry itself.

Why This Book?

Where Are the Customers’ Yachts? is an essential read for anyone seeking a better understanding of how money works, especially in the context of Wall Street’s incentives. It’s particularly valuable for those trying to decide whether to trust a financial advisor, how to start investing, or whether they’re falling into common psychological traps.

Unlike modern personal finance books that tend to focus on budgeting apps or debt repayment strategies, Schwed’s book offers timeless skepticism and perspective. It encourages readers to think critically and avoid blind trust in the financial system.

Final Thoughts

Reading Where Are the Customers’ Yachts? is a refreshing reminder that while financial tools and products have evolved, human nature—and Wall Street’s tendency to prioritize its own interests—has not. The book is an excellent complement to a frugal lifestyle and long-term investment strategy centered on the S&P 500. It reinforces the importance of learning about money not just from charts and data, but from understanding history, behavior, and incentives.

For readers of all financial backgrounds, Schwed’s book is a humorous yet sobering reminder to keep your goals in focus, question authority, and remember that your yacht matters more than anyone else’s.

You must be logged in to post a comment.