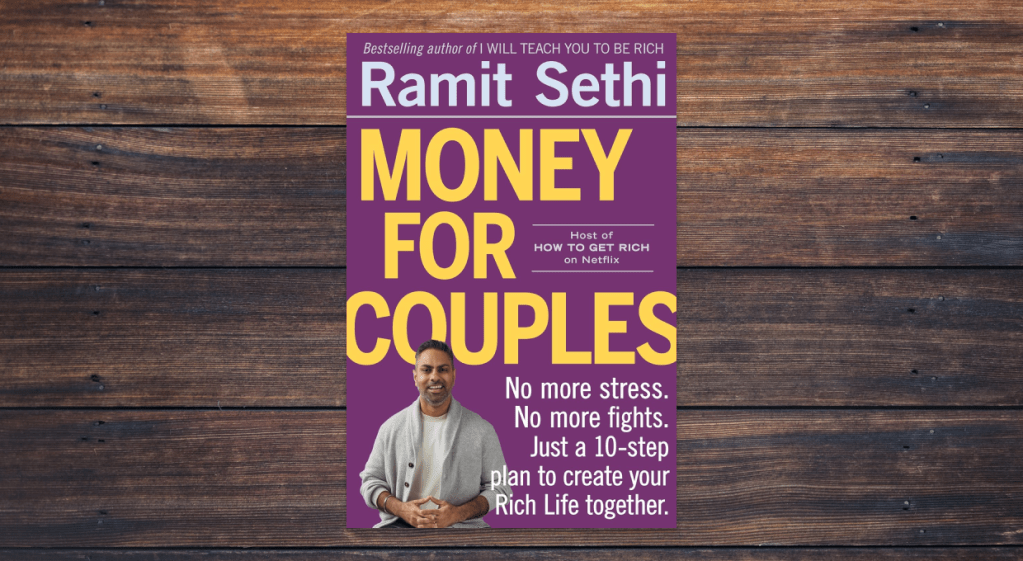

When it comes to love and money, most couples find themselves walking a tightrope. Ramit Sethi’s latest book, Money for Couples, aims to steady that line. With a straightforward 10-step plan, Sethi outlines how couples can stop fighting about money and start building a financial life that works for both partners.

Whether you’re newly engaged or decades into a relationship, this book is designed to help partners talk openly, build trust, and make smart decisions—together.

Who is Ramit Sethi?

Ramit Sethi is a personal finance author and entrepreneur best known for his best-selling book I Will Teach You to Be Rich. He has a background in psychology and human behavior, and he uses that knowledge to approach money through a lens of mindset, communication, and systems. Sethi hosts a podcast and Netflix show where he coaches real couples on how to overcome financial conflicts, making him a familiar voice to millions who want practical, behavior-based financial advice.

Sethi focuses on the emotional side of money—what people value, why they avoid certain conversations, and how to live a life they actually enjoy.

Key Lessons from Money for Couples

Sethi’s approach centers around creating a “Rich Life”—not necessarily about being wealthy, but about aligning your money with what truly matters to you and your partner. Here are some of the main takeaways:

Have The Big Money Talk Early

Money for Couples encourages couples to schedule a “Rich Life” conversation as early as possible. Instead of hiding behind vague goals like “save more” or “retire early,” couples are pushed to get specific about what they want their life to look like—and how their money can support it.

Define Roles and Responsibilities

Sethi helps readers navigate the messy territory of who pays what, how to split expenses fairly (not always equally), and how to balance different income levels. He also discusses merging finances versus keeping things separate, offering practical scripts and examples.

Tackle Debt and Save Together

There’s an emphasis on transparency—sharing debts, credit scores, savings goals, and investment accounts. The idea is to treat the relationship as a team effort, not a competition. Sethi shows how to create a shared financial system that works without relying on shame or secrecy.

Use Automation and Budgeting Tools

True to his previous work, Sethi recommends automating bills, savings, and investments. He suggests using budgeting apps to keep track of spending and to reduce day-to-day stress about money management.

Don’t Let Money Ruin the Relationship

Money for Couples makes a strong case that poor communication—not money itself—is what often leads to conflict. Sethi offers conflict-resolution tips and real dialogue examples that are useful for anyone navigating financial disagreements.

Criticisms of the Book

While Money for Couples is full of useful advice, it’s not without its flaws. Some readers may find the tone a little too polished or even overly confident. Sethi’s “scripted” conversations, while helpful to some, can come off as unnatural to others who prefer more nuance and less structure.

There’s also an assumption that both partners are open to deep introspection and willing to engage in uncomfortable conversations. That’s not always the case, and the book doesn’t always address how to handle situations where one partner is resistant or overwhelmed.

Finally, while Money for Couples covers the emotional and relational side of money well, it doesn’t go deep into advanced investing strategies or detailed budgeting techniques. For couples who already have a solid financial foundation, the advice may feel too basic.

Why This Book?

Couples often avoid talking about money until they’re in crisis. Money for Couples fills an important gap by helping partners have these conversations earlier—and more effectively. It encourages intentionality, collaboration, and honesty. If you’re serious about financial planning as a couple, this book is a good way to lay a foundation for the future.

It also aligns well with financial philosophies that emphasize frugal living, saving aggressively, and investing in low-cost index funds like the S&P 500. While not investment-heavy, it reinforces the importance of alignment, structure, and behavior (key elements in any long-term financial plan).

Final Thoughts

Money for Couples by Ramit Sethi is a solid, actionable guide for couples who want to stop arguing about money and start building a rich life together. It’s approachable, engaging, and rooted in real-world experience. Even if some advice feels a little scripted or surface-level, the book succeeds at making financial conversations feel doable—and even enjoyable.

For readers who are already budgeting, saving in a high-yield account, investing in the S&P 500, or exploring treasury bills, this book is a reminder that how you talk about money is just as important as how you manage it.

If you want to go beyond the numbers and focus on the relationship side of your financial life, this is a worthwhile read.

You must be logged in to post a comment.