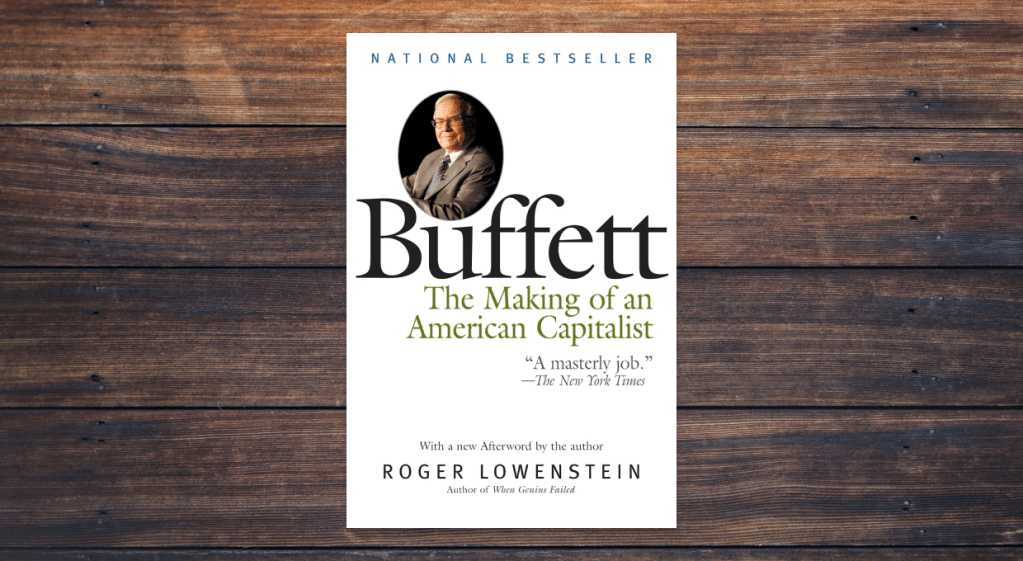

For anyone looking to deepen their understanding of money, investing, and the psychology behind financial decision-making, Buffett: The Making of an American Capitalist by Roger Lowenstein is an excellent starting point.

More than just a biography, this book traces Warren Buffett’s journey from a precocious boy in Omaha to one of the richest individuals in the world, with a focus on how he thinks about money, business, and life. It’s not just a story, it’s a case study in long-term thinking and financial discipline.

Who is Roger Lowenstein?

Roger Lowenstein is a financial journalist with a long career writing for The Wall Street Journal, The New York Times Magazine, and SmartMoney. His work has earned a reputation for clarity, insight, and depth. With Buffett, published in 1995, Lowenstein created one of the first major books to seriously examine Buffett’s life and investment philosophy. He didn’t just summarize Buffett’s wins—he took the time to explore how and why Buffett made his decisions. The result is a biography that feels more like a deep-dive into the mechanics of wealth building.

Lessons Readers Can Take Away

One of the most powerful takeaways from the book is the importance of patience and discipline. Buffett didn’t get rich quickly. He lived well below his means, bought businesses he understood, and avoided speculation. The book highlights how Buffett’s investment in companies like See’s Candies and The Washington Post weren’t just financially smart—they were grounded in principles that can be followed by ordinary investors.

Another key lesson is to invest in what you know. Buffett repeatedly avoided trends and fads, focusing instead on businesses with durable competitive advantages. For readers trying to make sense of the stock market, this mindset offers a reassuring alternative to the noise of day trading and meme stocks.

The book also explores how Buffett’s psychology—his temperament, his obsession with numbers, and his aversion to risk—played a huge role in his financial success. This focus on emotional control and rationality can be eye-opening for readers who struggle with overspending, lifestyle creep, or fear-driven investing.

Criticisms of the Book

While Buffett remains one of the most well-regarded books on Warren Buffett, it is not without criticism. Some readers may find the book too focused on business deals and financial minutiae. Those looking for a more personal or emotional portrait of Buffett might find it lacking in depth on his relationships, family life, or inner conflicts.

If a more personal look into Buffett’s life is what you’re looking for, we recommend The Snowball by Alice Schroeder.

Additionally, because the book was published in the mid-90s, it doesn’t cover Buffett’s later years or more recent investments. That doesn’t make the book obsolete, but it does mean readers may want to supplement it with more up-to-date sources or Buffett’s annual letters to shareholders.

Why This Book?

Buffett stands out among books on money because it offers more than just advice—it gives readers a framework for thinking about money in the long term. Instead of telling readers to “buy the S&P 500” or “live frugally” in a generic sense, it shows how someone applied those ideas over decades to build extraordinary wealth.

For readers trying to understand not just how to budget, but why it matters; not just how to invest, but how to think like an investor—Buffett is a rare find. It bridges the gap between biography and personal finance instruction, making it a practical and inspirational read.

Final Thoughts

Buffett: The Making of an American Capitalist is more than a book about a billionaire. It’s a story about consistency, discipline, and rationality—qualities that matter just as much for someone saving $100 a month as for someone managing a portfolio of millions. If you’re interested in learning how money works, how to build a life of financial independence, and how to avoid the traps of emotional decision-making, this book is well worth your time.

Pair it with a good budgeting app, a high-yield savings account, and an S&P 500 index fund, and you’ll be on the path to a smarter, more grounded financial future.

You must be logged in to post a comment.