Lawrence Lepard is a Boston-based investment manager best known for his strong advocacy of sound money principles and his belief in gold and Bitcoin as essential hedges against currency debasement. He runs Equity Management Associates (EMA), a private investment partnership focused on investing in what he calls “sound money” assets—primarily precious metals mining stocks and Bitcoin-related opportunities.

While not a household name in traditional finance circles, Lepard has gained a significant following among investors who are skeptical of central banking, fiat money, and government spending. His views are especially popular with those interested in Austrian economics, monetary history, and financial independence.

A Background Rooted in Traditional Finance

Lawrence Lepard graduated from Harvard Business School and worked for Fidelity and other firms before launching his own investment fund. He built his career in mainstream finance, but began to question the sustainability of the global monetary system after the 2008 financial crisis.

This turning point led him to study monetary history more deeply, and he became a student of the Austrian school of economics, which emphasizes the importance of hard money and limited government. Through this lens, he became a vocal critic of inflationary policies and began allocating investor capital toward assets that are resistant to money printing and currency devaluation.

A Champion of Gold and Bitcoin

Lepard is best known today for his outspoken support of gold and Bitcoin. He frequently appears on podcasts, YouTube interviews, and financial newsletters to make his case. He argues that fiat currencies are being systematically devalued by central banks and that savers and investors need to protect themselves by owning assets that cannot be printed at will.

Gold has been a traditional hedge against inflation for centuries, and Lepard continues to invest heavily in gold mining companies. He also became an early supporter of Bitcoin, seeing it as “digital gold” with the potential to serve as a store of value in the digital age.

Views on the Current Financial System

Lepard’s investment philosophy is rooted in skepticism of the current monetary system. He believes that excessive government spending, combined with artificially low interest rates, has led to massive distortions in global markets. In his view, this will eventually lead to a financial reckoning that will benefit those who hold scarce, sound assets.

His writing and interviews often include discussions on:

- The long-term risks of holding cash or bonds in an inflationary environment

- The importance of understanding monetary history

- Why central banks cannot stop printing money without causing a severe economic contraction

Writing and Media Presence

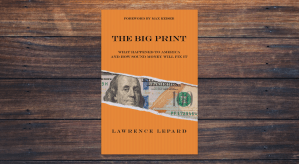

While not a prolific book author himself, Lawrence Lepard has written numerous investor letters and public essays that have been widely circulated online. These writings often include detailed arguments, charts, and historical comparisons that support his sound money thesis. His materials are frequently recommended to people who are interested in learning how money works and want a different perspective than what is usually offered by mainstream financial advisors.

For those looking for books on money and investing, Lepard frequently recommends reading:

- The Creature from Jekyll Island by G. Edward Griffin

- When Money Dies by Adam Fergusson

- The Bitcoin Standard by Saifedean Ammous

These books, along with Lepard’s commentary, can help readers better understand the role of monetary policy in shaping personal and national financial outcomes.

What Can Everyday Investors Learn?

Even if you don’t agree with all of Lepard’s positions, there are valuable takeaways from his philosophy:

Understand how money works

Most people don’t fully grasp how money is created, how inflation affects savings, or how interest rates influence asset prices. Lepard’s work encourages deeper financial literacy and critical thinking about these issues.

Diversify your holdings

Instead of putting all your money into cash or stocks, consider a diversified approach that includes hard assets like gold or a small allocation to Bitcoin.

Stay skeptical of easy answers

Lepard reminds investors that markets are complex and often manipulated by large forces. Staying informed and cautious can help you avoid risky financial behavior or lifestyle creep.

Should You Follow Lawrence Lepard’s Advice?

Lepard’s perspective is especially appealing to those who are looking for alternative views outside of traditional personal finance. His ideas align well with people who value frugality, long-term thinking, and independence from government-influenced systems.

However, investing in gold miners or Bitcoin can be volatile and is not for everyone. As always, it’s wise to consider your risk tolerance, time horizon, and financial goals before making investment decisions. For some, speaking with a financial advisor who understands both mainstream and alternative investment strategies may be a good next step.

Final Thoughts

Lawrence Lepard is an unconventional yet insightful figure in the world of finance. His commitment to sound money principles and skepticism of fiat currency has earned him respect among those who are concerned about inflation, central banking, and the future of wealth preservation.

For readers interested in budgeting, learning about financial history, and taking control of their money, exploring Lepard’s ideas can be a valuable part of the journey. Whether you decide to invest in gold or Bitcoin or simply want to understand the case for doing so, his work provides a compelling look at how different approaches to money management can shape financial outcomes over time.

You must be logged in to post a comment.