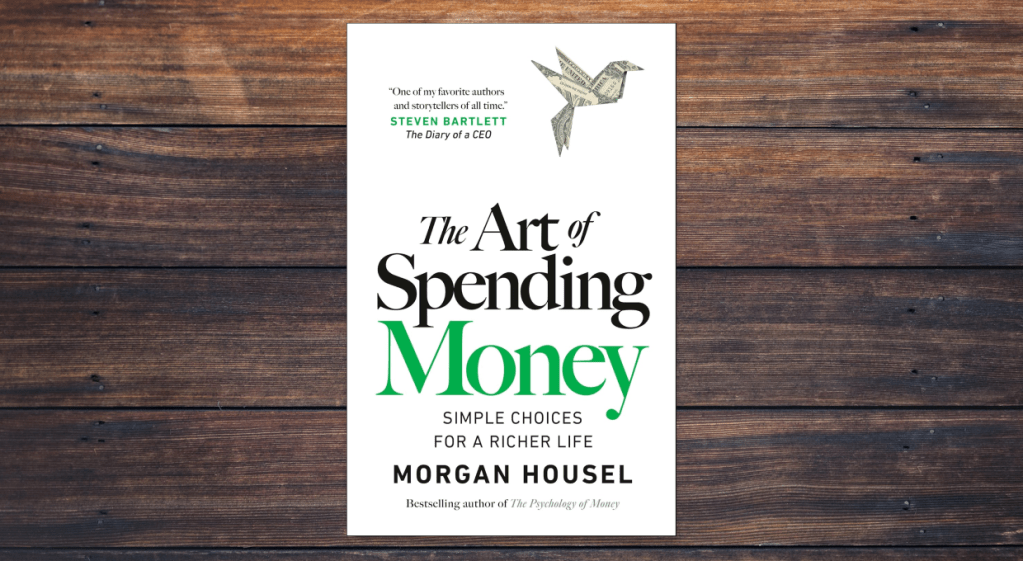

Morgan Housel’s The Art of Spending Money: Simple Choices for a Richer Life is a thoughtful exploration of what it means to use money well—not just to grow wealth, but to live better. Known for his clear thinking and storytelling ability, Housel challenges readers to rethink their assumptions about spending, happiness, and success.

Who is Morgan Housel?

Morgan Housel is a partner at The Collaborative Fund and a former columnist for The Motley Fool and The Wall Street Journal. His writing focuses on the psychology of money—how emotion, bias, and human behavior shape financial decisions far more than spreadsheets do. Housel’s previous bestseller, The Psychology of Money, became a modern classic in personal finance for its timeless lessons about humility, patience, and perspective in building wealth.

Lessons from The Art of Spending Money

While The Psychology of Money explored how people earn and invest money, The Art of Spending Money dives into the harder question: how do you use money once you have it? Housel argues that most people misunderstand the goal of wealth—it isn’t to maximize returns or accumulate endlessly, but to buy freedom, control, and peace of mind.

Here are a few key lessons readers can take away:

Money is a tool for autonomy, not status.

Housel reminds readers that the real value of money comes from the ability to make choices—where to live, how to spend time, and who to spend it with. Using money to impress others, he warns, often leads to dissatisfaction.

The best purchases are emotional, not financial.

A theme throughout the book is that satisfaction from spending rarely comes from things. Experiences, relationships, and time—these yield a higher return on happiness. Housel shares examples of people who spent lavishly yet remained unhappy, contrasted with those who lived modestly but with purpose and joy.

The point of saving is to eventually spend wisely.

Many financially disciplined people struggle with letting go of money even when they can afford to. Housel suggests viewing spending as part of a complete financial life cycle—save aggressively when young, then deploy that money intentionally when it can improve your quality of life or someone else’s.

Happiness has diminishing returns beyond a certain point.

Consistent with research on income and well-being, Housel shows that once basic needs are met, the incremental happiness from additional money drops sharply. He encourages readers to define “enough” early to avoid the trap of endless accumulation.

Criticisms of the Book

While the book’s ideas are insightful, some readers may find them familiar. Many of Housel’s themes—such as the psychology of satisfaction or the pitfalls of lifestyle creep—revisit ground covered in his earlier work. Others may feel the book is more philosophical than practical, offering perspective rather than step-by-step financial guidance.

Additionally, readers looking for detailed strategies on investing, budgeting, or debt reduction may find the content too abstract. Housel’s style leans heavily on storytelling, which makes the book engaging but occasionally repetitive for those who prefer hard data and action plans.

Should You Buy It?

If you’re in a stage of life where you’ve accumulated some savings and want to think more deeply about how to use it, then yes. The book isn’t about getting rich; it’s about using money to live intentionally. It’s particularly relevant for those who value freedom, simplicity, and emotional well-being over material excess.

However, readers new to personal finance may want to start with The Psychology of Money first, as it provides the foundation for Housel’s ideas about earning, saving, and investing. The Art of Spending Money is best appreciated as a companion piece that completes the financial story.

Final Thoughts

The Art of Spending Money is less a finance manual and more a meditation on life priorities. Morgan Housel continues to demonstrate that the hardest part of money management isn’t math—it’s self-awareness. By reframing spending as a reflection of values rather than a pursuit of status, Housel invites readers to see money not as an end, but as a means to a richer, more meaningful life.

For anyone seeking to balance frugality with fulfillment, this book offers clarity, humility, and a gentle reminder that wealth is only useful when it helps you live the way you want.

You must be logged in to post a comment.