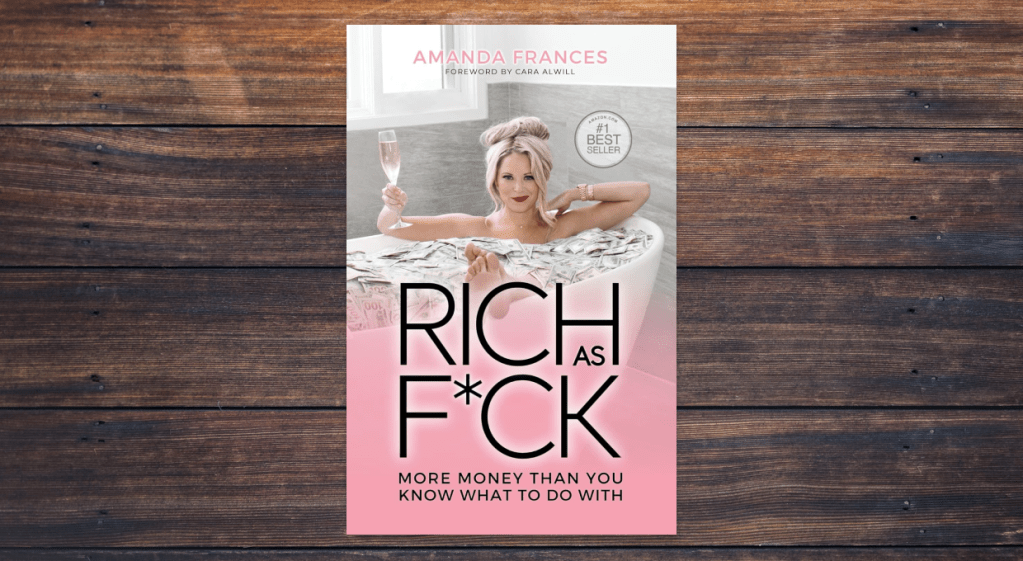

Rich As F*ck: More Money Than You Know What to Do With is a polarizing entry in the books on money genre. Written in a bold, conversational style, the book blends mindset coaching, personal anecdotes, and motivational advice around earning and attracting wealth. It is not a traditional personal finance guide, and readers expecting spreadsheets, budgeting frameworks, or investing strategies should understand that distinction upfront.

Who is Amanda Frances?

Amanda Frances is a self-described money mindset coach and entrepreneur. She built her brand through online courses, coaching programs, and social media, where she focuses on themes like self-worth, abundance, and financial confidence. Her work is rooted more in psychology and belief systems than in conventional financial education. Frances positions herself as someone who transformed her own income dramatically by changing how she thinks about money, success, and personal value.

Key Lessons Readers Can Take Away

One of the central ideas in the book is that beliefs about money shape financial outcomes. Frances argues that many people unconsciously limit their earning potential through guilt, fear, or negative associations with wealth. The book encourages readers to examine those beliefs and replace them with a mindset that sees money as neutral and accessible.

Another takeaway is the emphasis on personal responsibility. Frances repeatedly stresses that financial improvement starts with internal change, not external circumstances. For some readers, this message can be empowering, especially those who feel stuck or intimidated by traditional financial systems.

The book also highlights the importance of charging appropriately for your work. Entrepreneurs, freelancers, and service providers may find value in the discussion around underpricing, people-pleasing, and discomfort with earning more. While it does not replace advice from a financial advisor, it may prompt readers to think differently about income ceilings they have set for themselves.

Criticisms of the Book

The most common criticism is the lack of practical financial guidance. There is little discussion of budgeting, saving, investing, or risk management. Readers looking to learn how to use a high-yield savings account, invest in the S&P 500, or manage spending will not find step-by-step instruction here.

The book also leans heavily on anecdotal evidence. Success stories are presented as proof of the philosophy, but there is limited acknowledgment of external factors like market conditions, timing, or privilege. This can make some of the claims feel overly simplistic or unrealistic.

Additionally, the tone may not resonate with everyone. The language is intentionally provocative and repetitive, which some readers find motivating and others find distracting. Those who prefer data-driven analysis or academically grounded financial learning may struggle with the style.

Should You Buy the Book?

Whether this book is worth buying depends on what you are looking for. If you are interested in the psychology of money and want a motivational push to think bigger about income, Rich As F*ck may be useful. It can complement more traditional books on money by addressing the emotional side of earning and self-worth.

However, it should not be treated as a standalone financial education. Readers still need to learn budgeting basics, understand investing fundamentals, and make informed decisions about saving and long-term wealth building. Pairing this book with practical resources or guidance from a qualified financial advisor would be a more balanced approach.

Final Thoughts

Rich As F*ck: More Money Than You Know What to Do With is best viewed as a mindset book rather than a personal finance manual. Its strength lies in challenging readers to question their beliefs about money and success. Its weakness is the absence of concrete financial instruction.

For readers early in their financial journey, it may serve as inspiration but should be supplemented with practical learning. For those already comfortable with budgeting and investing, it may offer a fresh perspective on the emotional barriers that influence financial decisions. As with many books on money, its value depends on how thoughtfully the reader applies its ideas.

You must be logged in to post a comment.