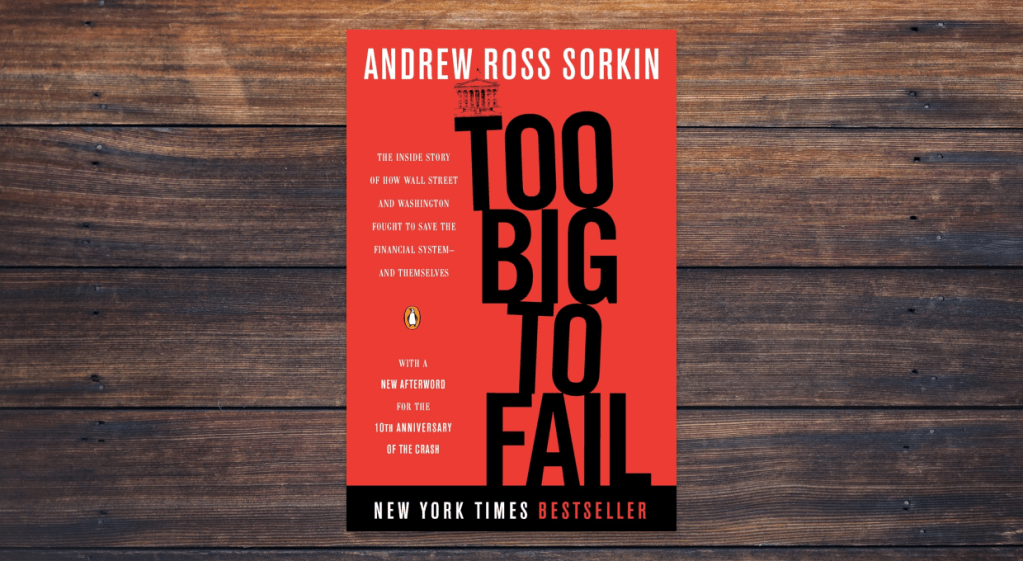

Too Big to Fail is a gripping narrative of the 2008 financial crisis told through the eyes of the bankers, policymakers, and regulators who lived it. Written by journalist Andrew Ross Sorkin, this book offers a detailed, behind-the-scenes look at the most significant economic collapse since the Great Depression. It’s not a how-to guide for personal finance, but it’s essential reading for anyone who wants to better understand how the financial system works… and how close it came to unraveling.

Who is Andrew Ross Sorkin?

Andrew Ross Sorkin is a financial columnist for The New York Times and co-anchor of CNBC’s Squawk Box. He’s known for his deep understanding of Wall Street, access to key financial players, and ability to turn complex economic events into compelling stories. Too Big to Fail, his debut book, became a bestseller and is widely considered one of the definitive accounts of the financial crisis.

Key Lessons from Too Big to Fail

Financial literacy isn’t optional

Too Big to Fail makes it clear that even the most powerful decision-makers sometimes fail to fully grasp the systems they’re managing. For everyday readers, this serves as a reminder: if you want to protect yourself financially, you need to understand how money, credit, and the markets operate. Reading books on money like this one can help you see the bigger picture.

Psychology drives financial decisions

Whether it’s panic in a boardroom or hubris in a trading floor, emotions play a massive role in financial decision-making. Too Big to Fail illustrates how fear and ego influenced billion-dollar decisions—something that applies just as much to individual investors and budgeters.

Accountability is rare at the top

“Too Big to Fail” refers to institutions that were deemed so large and interconnected that their failure would endanger the entire financial system. But one of the book’s implicit messages is that many of the individuals responsible for risky decisions walked away unscathed. For readers, it’s a reminder to take control of their own finances and not assume the system is built to protect them.

Diversification and liquidity matter

While the book focuses on banks and hedge funds, the underlying lesson is useful for personal finance: when things go wrong, access to cash and diversified investments can be the difference between survival and collapse. That’s why we recommend keeping money in a high-yield savings account, short-term treasury bills, and building a nest egg in the S&P 500.

Criticisms of the Book

While Too Big to Fail has received praise for its detailed reporting and cinematic storytelling, it’s not without criticism:

- Sympathetic portrayal of Wall Street: Some critics argue that the book is too generous to the bankers and executives it profiles, portraying them more as victims than as culprits of the financial collapse.

- Dense with names and details: Readers unfamiliar with finance might feel overwhelmed by the sheer number of characters and firms. It reads more like a thriller than a textbook, which can be disorienting if you’re looking for step-by-step financial education.

- Limited critique of systemic issues: Too Big to Fail focuses heavily on the drama of the crisis rather than exploring deeper systemic flaws in capitalism, regulation, or corporate governance.

Should You Read Too Big to Fail?

Yes, especially if you’re interested in learning more about the forces that shape our financial system. While it won’t teach you how to build a budget or which savings account to open, it offers valuable insights into how financial crises unfold and the human behaviors that drive them.

For readers interested in becoming more financially literate, this book can be a gateway. Pair it with more tactical personal finance books like The Simple Path to Wealth by JL Collins or Your Money or Your Life by Vicki Robin to round out your education.

Final Thoughts

Too Big to Fail is a fast-paced, eye-opening read that shines a light on the fragility of the financial system and the human psychology behind it. It’s not a personal finance manual, but it is essential reading for anyone who wants to understand the larger forces that can affect their savings, investments, and financial future. If you want to deepen your knowledge of how money and power work at the highest levels, this book is worth your time and your bookshelf.

You must be logged in to post a comment.