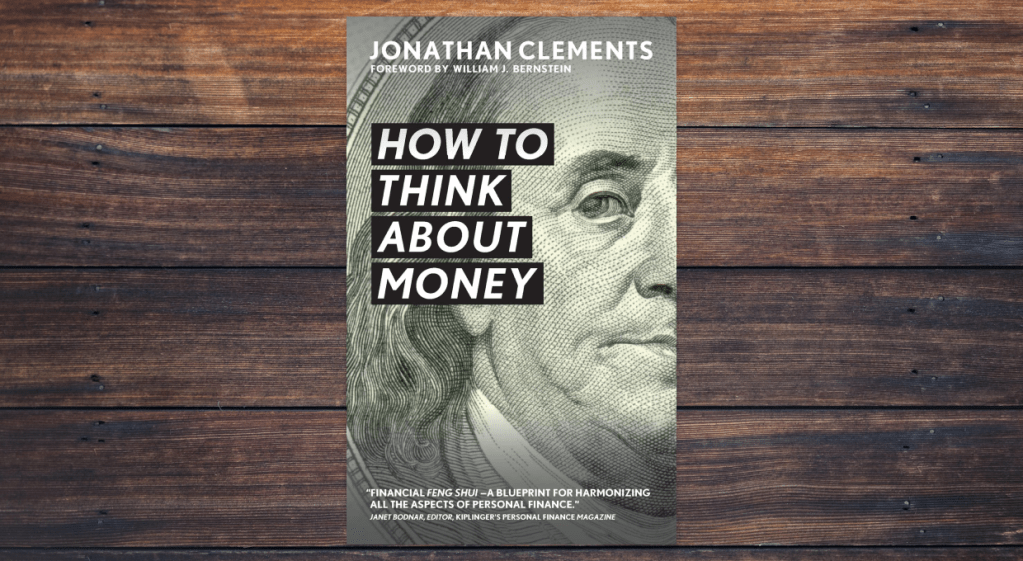

Understanding money isn’t just about crunching numbers. It’s about psychology, behavior, and long-term thinking. Few books capture this idea as clearly and practically as How to Think About Money by Jonathan Clements.

This short but impactful book blends behavioral finance, personal reflection, and timeless advice into a compelling guide for anyone trying to build a smarter financial life.

Who is Jonathan Clements?

Jonathan Clements is a well-known personal finance journalist with decades of experience writing for outlets like The Wall Street Journal. He’s also the founder of the financial wellness site HumbleDollar. Clements has spent his career making money topics accessible and relatable for everyday readers. Unlike many financial experts, he doesn’t talk down to his audience or promise secrets to getting rich quick. Instead, he focuses on how to live a good life by managing money thoughtfully and with purpose.

Lessons From the Book

The central message of How to Think About Money is that wealth is not about having a huge bank account. It’s about having control over your time and being able to live life on your own terms. That mindset runs through every chapter.

Here are some key takeaways:

Spend money on experiences, not things

Research shows that people derive more lasting happiness from experiences than from material goods. Clements encourages readers to align their spending with what truly brings them joy.

Understand your own financial psychology

We all have biases that cloud our money decisions. Whether it’s overconfidence, fear, or herd mentality, Clements explains how understanding these mental traps can help you make smarter financial choices.

Delay gratification and invest consistently

How to Think About Money champions investing in low-cost index funds, particularly the S&P 500. Clements emphasizes that long-term investing (read: not chasing hot stocks) is the path to lasting wealth.

Your time is your most valuable asset

One of the book’s strongest themes is that money is a tool to gain freedom. That means buying back your time through financial independence, rather than using money to upgrade your lifestyle unnecessarily.

Don’t underestimate simple strategies

Clements makes the case for boring but effective financial strategies. Budgeting with a reliable app, keeping money in high-yield savings accounts or treasury bills, and avoiding lifestyle creep are all part of a successful financial game plan.

Criticisms of the Book

While How to Think About Money offers timeless advice, some readers may find it too light on specific tactics. The book is less of a “how-to” guide and more of a “how to think” guide, which means it’s not ideal for someone looking for a step-by-step plan.

Some critics also note that Clements tends to repeat ideas that appear in his earlier writing, and the book doesn’t break much new ground for seasoned personal finance readers. However, this is often a strength for beginners, who benefit from clear, consistent messaging.

Why This Book?

There are countless books on money, but few combine behavioral finance with real-world application as well as this one. It’s a fast, approachable read that offers more than just financial advice. It offers perspective. For readers who are focused on frugal living, long-term investing, and building a nest egg in the S&P 500, this book reinforces the value of patience, intentionality, and simplicity.

Final Thoughts

How to Think About Money is a book that belongs on every financially curious reader’s shelf. It’s especially useful for those at the beginning or midpoint of their financial journey who are trying to figure out not just what to do with their money, but why. Jonathan Clements doesn’t sell a dream of fast riches—he offers something better: clarity. And in a world filled with financial noise, that clarity is priceless.

You must be logged in to post a comment.