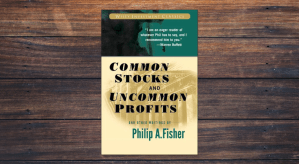

Scuttlebutt research is a timeless and underappreciated technique in the world of investing. Popularized by legendary investor Phil Fisher in his 1958 classic Common Stocks and Uncommon Profits, the method involves gathering firsthand information about a company by talking to the people who know it best—customers, competitors, suppliers, employees, and industry experts.

Rather than relying solely on financial statements and analyst reports, scuttlebutt emphasizes the importance of on-the-ground, real-world insight to evaluate the quality of a business. In a world flooded with stock screeners and AI-generated investment ideas, this boots-on-the-ground approach is refreshingly human.

The Origin of the Term “Scuttlebutt”

The word “scuttlebutt” originally comes from naval slang, referring to the cask of drinking water around which sailors would gather to exchange gossip. Phil Fisher repurposed the term for investing, describing the informal conversations and inquiries investors can make to uncover valuable information not found in annual reports.

This method aligns with the principle that some of the best insights about a business come not from spreadsheets, but from real people who interact with the company every day.

How Scuttlebutt Research Works

Fisher believed that great investments often came from great companies, and great companies tend to leave a trail of clues. Here’s how a typical scuttlebutt process might unfold:

Identify a Company of Interest

Choose a business that appears promising based on its financials or a compelling product or service.

Talk to Customers

What do users of the company’s product or service think? Are they loyal? Do they recommend it to others?

Speak with Suppliers

Does the company pay its bills on time? Are relationships stable? Suppliers often have unique visibility into a company’s operational health.

Check in with Competitors

Competitors often know what sets a company apart—or what weaknesses it has.

Interview Employees (Former or Current)

What’s the culture like? Is management respected? Are the company’s values reflected in how it treats its staff?

Ask Industry Experts

Analysts, consultants, or trade publication editors can provide high-level context and help benchmark the company within its sector.

The goal is to build a 360-degree view of the company—its reputation, strategic advantages, operational execution, and ability to maintain its position over time.

Why Scuttlebutt Still Matters Today

Although scuttlebutt research requires time, initiative, and social curiosity, it remains a powerful way to uncover insights others miss. In an era of passive investing and algorithmic trading, it offers an edge to those willing to do the work.

Warren Buffett, though a student of Ben Graham’s value investing, credited Phil Fisher’s scuttlebutt approach for influencing how he evaluates quality businesses. Buffett’s investment in See’s Candies, for example, stemmed in part from learning about its reputation and pricing power through informal research.

Scuttlebutt and Everyday Investors

You don’t need to be a professional analyst to apply scuttlebutt principles. Here’s how retail investors can use this approach:

- Test Products Yourself: Are you considering investing in a consumer company? Try the product or service and compare it to alternatives.

- Read Reviews: Dive into consumer feedback on Amazon, Reddit, Yelp, and forums. Patterns in sentiment can be telling.

- Talk to People: Ask friends or acquaintances who work in relevant industries what they think about a business.

- Visit Stores or Locations: Observe customer traffic, employee behavior, and overall experience.

This type of research complements traditional financial analysis and helps ground your investment decisions in reality, not just ratios.

Final Thoughts

Scuttlebutt research encourages curiosity, patience, and independent thinking. It helps you look past the noise of Wall Street headlines and focus on what actually drives business success. Phil Fisher’s method is not about finding a quick stock tip—it’s about developing a deeper understanding of a company’s strengths and staying power.

As you build your portfolio and financial knowledge, consider incorporating scuttlebutt into your process. It may not be fast, but it’s often far more rewarding than simply chasing trending tickers.

The best investors don’t just read about businesses—they go out and learn them.

You must be logged in to post a comment.