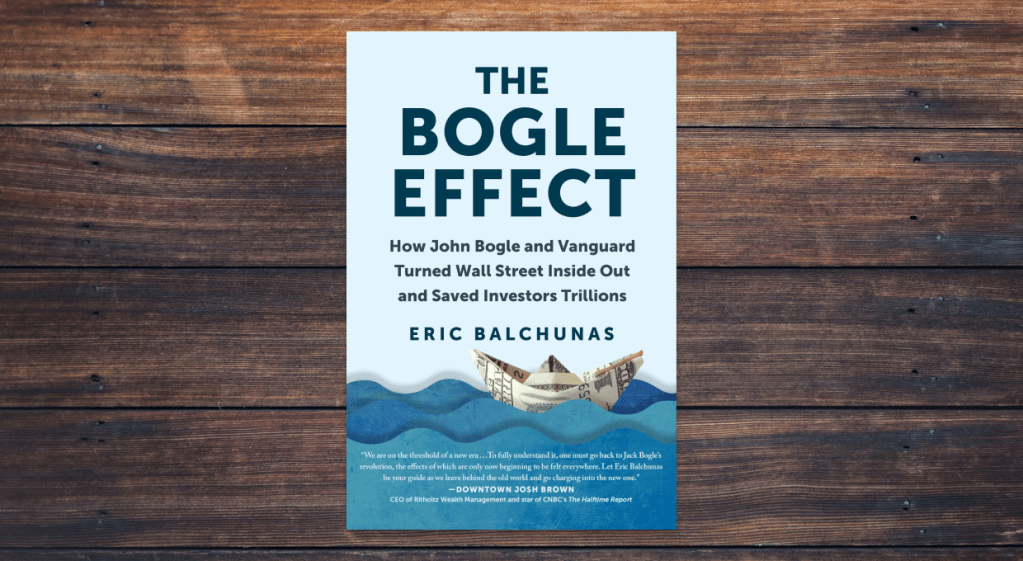

The Bogle Effect by Eric Balchunas is a captivating tribute to one of the most influential figures in the world of investing, John C. “Jack” Bogle. For anyone pursuing financial independence or seeking a deeper understanding of how to grow wealth through frugal and intelligent choices, this book is a must-read.

Balchunas masterfully explores Bogle’s impact on the financial industry, his dedication to simplicity, and the creation of the index fund, a revolutionary tool that has democratized investing for millions of people.

Jack Bogle’s Legacy: A Champion for the Everyday Investor

Jack Bogle founded Vanguard in 1975 with a mission that was radically different from the norm. Instead of focusing on maximizing profits for the company, he aimed to minimize costs for investors (what a good deal for us!). This ethos gave birth to the first index fund, which allows individuals to invest in a diverse basket of stocks at minimal expense.

Bogle’s philosophy, dubbed “Bogleism”, emphasized three core principles:

- Minimizing Costs: High fees erode returns over time, and Bogle was relentless in his push to lower them. His innovations have saved investors billions of dollars.

- Long-Term Focus: Bogle encouraged investors to stay the course and avoid the temptations of short-term trading.

- Simplicity: His approach to investing eschewed complexity, favoring broad market exposure through low-cost index funds like Vanguard’s S&P 500 fund.

Today, Bogle’s vision lives on, with Vanguard managing trillions of dollars in assets and continuing to champion the cause of the everyday investor.

Why Index Investing is the Best Choice, Regardless of Net Worth

One of the most compelling arguments in The Bogle Effect is how universal index investing is. Whether you’re a college student just starting out or a millionaire looking to preserve wealth, the principles of index investing apply equally. Here’s why:

- Low Costs: Index funds typically have expense ratios below 0.1%, compared to the 1% or more charged by actively managed funds. Over decades, these savings compound significantly.

- Diversification: With a single index fund like $VOO (our favorite), you gain exposure to hundreds of companies across various industries, reducing risk.

- Market Performance: Active fund managers often fail to outperform the market after fees. Index funds, by design, match the market’s performance, which historically has delivered an average annual return of around 10%.

- Simplicity and Accessibility: Index investing eliminates the need for constant market monitoring and analysis, making it an ideal strategy for busy professionals and retirees alike.

The Bogle Effect on Financial Independence

The Bogle Effect delves into how Bogle’s innovations have fueled the FIRE (Financial Independence, Retire Early) movement. By enabling investors to build wealth with minimal fees and effort, Bogle’s index funds have become a cornerstone for those seeking financial independence.

Adopting the Bogle philosophy means embracing a frugal lifestyle, investing excess income in low-cost index funds like $VOO, and letting compounding work its magic over time.

Final Thoughts

The Bogle Effect is more than just a biography; it’s a rallying cry for a smarter, more equitable approach to investing. Eric Balchunas provides a detailed yet accessible account of Jack Bogle’s life and the transformative impact of his work. This book serves as both a history lesson and a practical guide for anyone looking to take control of their financial future.

For those starting their financial journey, The Bogle Effect is a reminder of the power of low-cost, long-term investing. Let Jack Bogle’s legacy inspire you to make smart financial choices and stay the course toward your goals.

You must be logged in to post a comment.