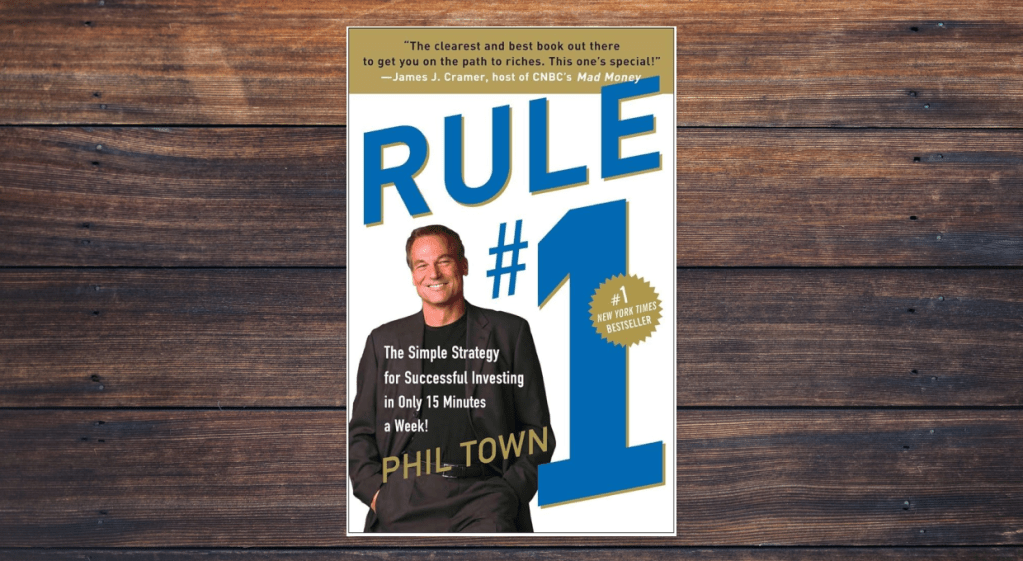

If you’re embarking on your financial journey, you might wonder which resources can help you build a solid foundation. Rule #1: The Simple Strategy for Successful Investing in Only 15 Minutes a Week! by Phil Town is a highly recommended read for aspiring investors.

Whether you’re just starting or looking to refine your investment approach, this book offers valuable insights into simplifying stock market investing.

Who Is Phil Town?

Phil Town is an accomplished investor, motivational speaker, and former river guide (really) who transitioned to the world of finance after learning the secrets of investing from a successful businessman. Town’s journey is particularly inspiring for beginners because he started with little knowledge about investing and became a self-made millionaire. His relatable background and ability to break down complex concepts make him a favorite among readers seeking practical financial advice.

What Is Rule 1 About?

At its core, Rule #1 is a guide to investing based on the principles of legendary investor Warren Buffett. The title refers to Buffett’s famous quote:

Rule #1: Never lose money. Rule #2: Never forget Rule #1.

Phil Town outlines a straightforward strategy for identifying and investing in high-quality companies that are likely to deliver long-term returns. The book emphasizes four critical principles, known as the “Four Ms”:

- Meaning: Invest in businesses you understand and care about.

- Moat: Identify companies with competitive advantages that protect their market position.

- Management: Ensure the company’s leadership is trustworthy and competent.

- Margin of Safety: Buy stocks at a discount to their intrinsic value to minimize risk.

Through these principles, Town equips readers with a framework for evaluating stocks and making informed investment decisions.

Key Takeaways

Rule #1 aligns with our values, promoting a disciplined, frugal, and informed approach to financial independence. Here are some key takeaways for our readers:

- Invest in What You Know: Town’s focus on understanding the companies you invest in echoes the importance of being mindful and intentional with your financial choices.

- Long-Term Focus: Like the recommendation to build a $VOO nest egg, Rule #1 encourages patience and holding investments for the long haul.

- Risk Management: Town’s emphasis on the margin of safety aligns with strategies to minimize risks while pursuing financial growth.

- Empowerment Through Education: The book provides actionable steps to demystify investing, making it accessible even for beginners.

Is Rule #1 for Beginners or Advanced Investors?

Rule #1 is primarily tailored for beginners but contains insights that even intermediate investors can appreciate. The language is straightforward, and the step-by-step explanations make it an excellent starting point for those new to investing. Advanced investors may find the concepts basic but can still benefit from revisiting foundational principles.

Final Thoughts

Phil Town’s Rule #1 is a valuable addition to any aspiring investor’s bookshelf. Its clear, actionable advice empowers readers to take control of their financial future without feeling overwhelmed. By focusing on understanding businesses, mitigating risks, and thinking long-term, this book offers practical wisdom that aligns with the principles we advocate at Winchell House.

Whether you’re looking to complement your $VOO investments, which should be the bulk of your portfolio, or explore individual stocks, Rule #1 provides a roadmap for making informed decisions. If financial independence is your goal, consider adding this book to your reading list and taking the first steps toward mastering the art of investing.

You must be logged in to post a comment.