Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger is more than just a book—it’s a treasure trove of timeless insights into investing, decision-making, and personal finance.

Compiled by Peter D. Kaufman, this volume captures the wit, wisdom, and unconventional thinking of Charlie Munger, a legendary figure in the world of finance. For anyone on a journey toward financial independence, this book offers a refreshing perspective on how to think about money, investments, and even day-to-day budgeting.

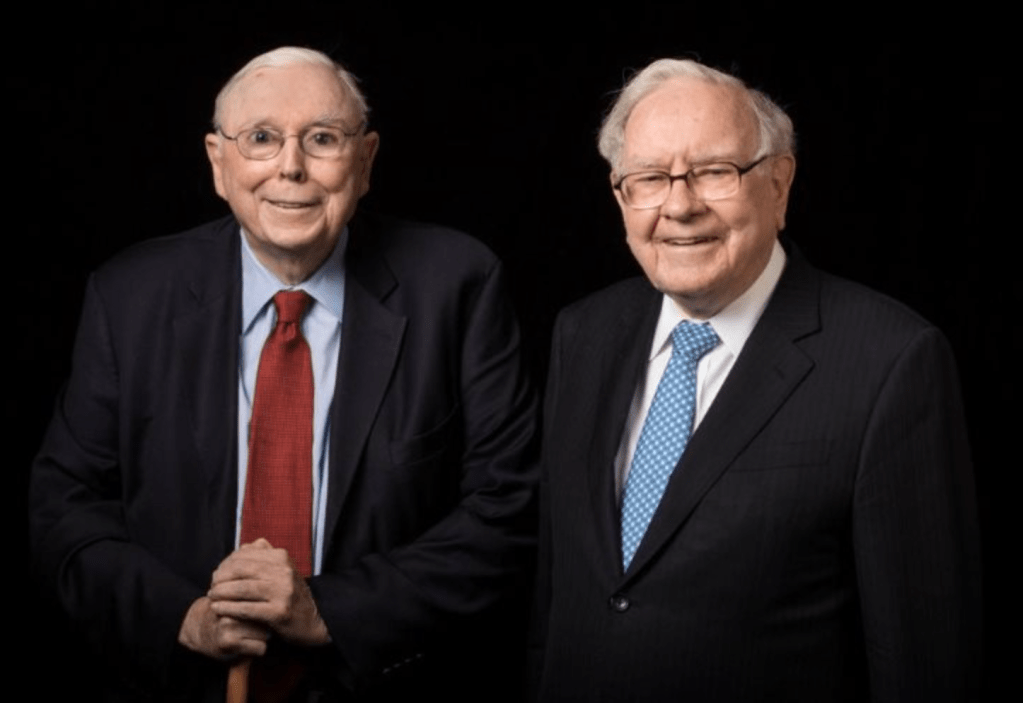

Who is Charlie Munger?

Charlie Munger is best known as the long-time partner of Warren Buffett and the vice chairman of Berkshire Hathaway. His approach to investing is rooted in deep rationality, discipline, and an unyielding commitment to frugality. Munger’s principles emphasize the importance of thinking independently, avoiding excessive credit card debt, and steering clear of unnecessary financial risks. His lessons not only resonate with seasoned investors but also provide practical advice for anyone looking to improve their financial well-being.

Who is Peter D. Kaufman?

Peter D. Kaufman is an accomplished investor and financial writer who has played a significant role in chronicling the philosophies of modern investing. In this book, Kaufman curates and presents Munger’s ideas in a way that is both accessible and thought-provoking. His work helps bridge the gap between high-level investment strategies and everyday financial decisions, making the wisdom of Munger applicable even for those new to the world of personal finance.

Investing Lessons

One of the core strengths of Poor Charlie’s Almanack is its ability to distill complex investing concepts into practical lessons. Readers can learn about:

- Long-term Thinking: Munger advocates for patience and a focus on the long run, a mindset that aligns well with investing in diversified vehicles like the S&P 500.

- Avoiding Excessive Debt: By emphasizing the dangers of over-leveraging—such as accumulating high-interest credit card debt—Munger reinforces the importance of maintaining a solid budget.

- Frugality and Value Investing: Poor Charlie’s Almanack encourages living below your means, a principle that supports building a nest egg through a combination of high-yield savings accounts, short-term treasury bills, and well-chosen investments.

- Continuous Learning: Whether you’re working with a trusted financial advisor or managing your own portfolio, Munger’s insistence on lifelong learning can lead to smarter financial decisions.

Final Thoughts

Poor Charlie’s Almanack stands as a testament to the enduring value of smart, disciplined investing. Whether you’re focused on achieving financial independence, managing your budget, or avoiding pitfalls like credit card debt, the lessons from Charlie Munger offer timeless guidance.

As you embark on your financial journey, perhaps with the assistance of a financial advisor or through self-directed investments in a high-yield savings account and the S&P 500, remember that the principles of frugality, continuous learning, and long-term planning can pave the way to lasting financial success.

You must be logged in to post a comment.