In a recent conversation on the Prof G podcast, Barry Ritholtz, co-founder and chief investment officer of Ritholtz Wealth Management, shared his perspectives on common investment pitfalls and strategies for achieving financial independence.

Avoiding Common Investment Mistakes

Ritholtz emphasizes the importance of steering clear of frequent investment errors that can hinder financial growth. He advocates for a disciplined approach to investing, cautioning against emotional decisions that often lead to suboptimal outcomes.

The Power of Passive Investing

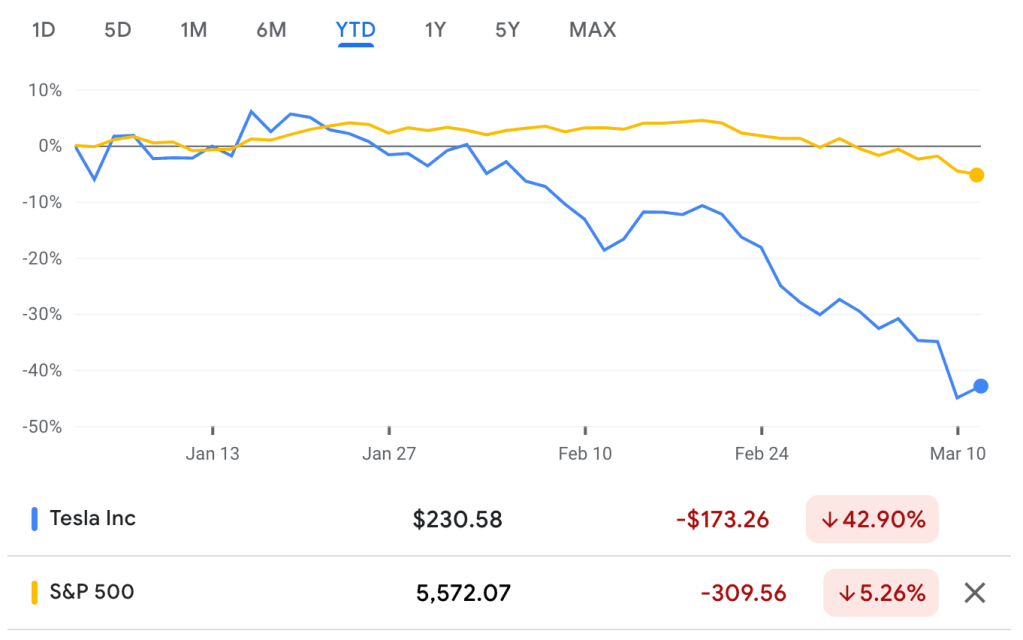

A significant portion of the discussion centers on the benefits of passive investing. Ritholtz highlights how low-cost index funds, particularly those tracking the S&P 500 (we like $VOO), have historically provided robust returns. This aligns with Winchell House’s philosophy of investing excess funds into the S&P 500, which has averaged a 10% annual return over time.

“If you can’t get control of your limbic system, you’ll die poor”

The Role of Financial Advisors

Ritholtz also touches upon the value of consulting with financial advisors. He notes that while many investors can manage their portfolios independently, professional guidance can offer tailored strategies and help avoid common pitfalls, especially for those new to investing.

Aligning with Our Principles

The insights from this conversation resonate with our commitment to promoting financial literacy and prudent investment strategies.

By focusing on avoiding common mistakes, embracing passive investment vehicles, and seeking professional advice when necessary, individuals can enhance their journey toward financial independence.

For a more in-depth understanding, you can watch the full discussion here:

You must be logged in to post a comment.