A question that frequently comes up in the Financial Independence/Retire Early community is something along the lines of, “I’ve saved up $100,000. Should I put it in the stock market or use it to buy a house?”

The question itself is flawed. Despite what you may have been told growing up, your house is not the best monetary investment.

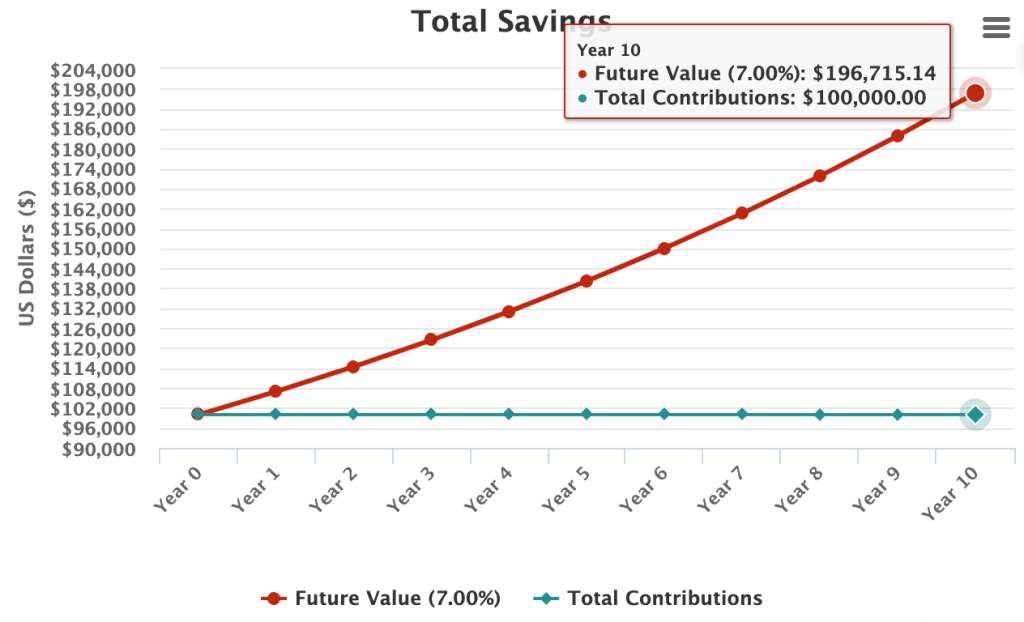

Consider this: an investment in the S&P 500 will, on average, give you an annual return of 7%. That means any money you put in the S&P 500 will double every 10 years.

Your house will likely not double in value every 10 years. Does that mean it’s a bad investment? No, it just means it won’t make you as much money as you would if you had put that down payment money in the S&P 500.

But here’s the thing, owning your home is still a good physiological investment. You can’t shelter your family in the S&P 500. You can sleep well at night knowing a landlord won’t suddenly raise your rent or, worse, kick you out on the street.

And owning your home may free you up to take more risks than you normally would if you didn’t own your home which may then lead to more financial success.

So if we consider the question again, the answer might be: “What’s more important to you, more money or a place to call your own?”

This article is part of the Winchell House Original Articles series.

You must be logged in to post a comment.