Like the simple humans we are, we crave certainty. Will I have enough to retire? Will by daughter be okay going to that party? Will my marriage last?

The reality is that, no matter how you crunch the numbers (if there’s even numbers to be crunched), no prediction is entirely accurate. Sorry to say, that applies to The 4% Rule as well.

In fact, a rule regarding predictions I try to keep in mind is that, the further out a prediction is and the more specific the prediction is, the less likely it’ll be true. There’s just too many things that we don’t know of that can go wrong or right.

“The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.” – Daniel J. Boorstin

That brings me to prediction markets.

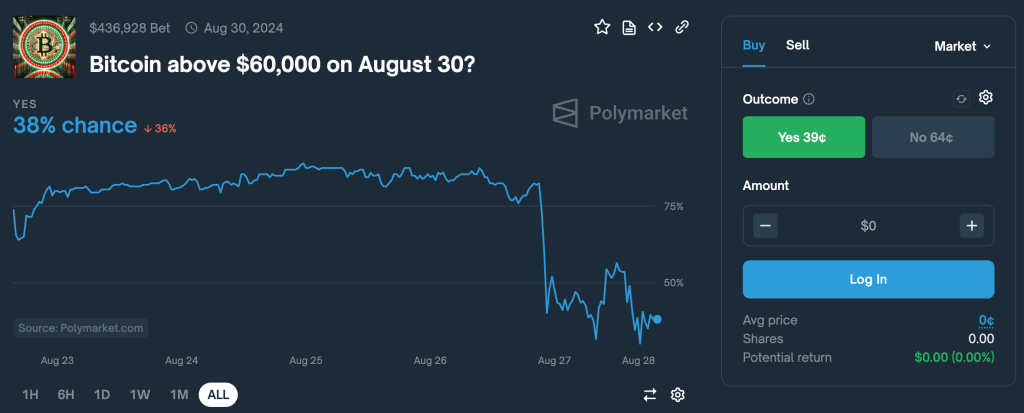

Folks look at prediction markets, like Polymarket, and say “Well, since the predictors are putting money on the line” then they must be right.

Another way to think about it is: these predictors don’t know they can’t predict the future, but they do know they have money to burn.

Bitcoin predictions for example. Bitcoin is in fact a speculative asset (like art). There is no predicting what the price may be since it isn’t tied to any sort of intrinsic value.

But here on Polymarket is a bet trying to predict what the price will be:

Remember, regardless of how informed someone may feel they are:

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.” – John Kenneth Galbraith

This article is part of the Winchell House Original Articles series.

You must be logged in to post a comment.