Neo-banks, or digital-only banks, have transformed the financial landscape, offering innovative solutions for modern banking needs. This article explores the benefits, features, and top neo-banks, providing insights for savvy individuals seeking streamlined financial management.

What are Neo-Banks?

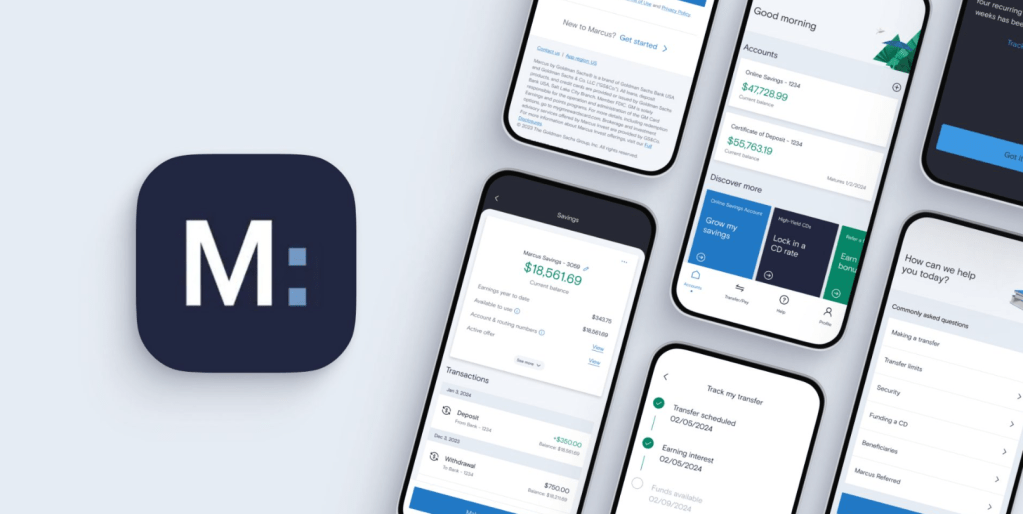

Neo-banks are financial institutions that operate exclusively online or through mobile apps, eliminating traditional branch networks.

Key Benefits of Neo-Banks

- Convenience: Manage finances anywhere, anytime.

- Lower Fees: Reduced or eliminated maintenance, overdraft, and ATM fees.

- Higher Interest Rates: Competitive rates for savings accounts.

- User-Friendly Apps: Intuitive interfaces for seamless banking.

Top Neo-Banks

- Chime: Offers fee-free overdrafts and early direct deposit.

- SoFi Money: Provides cashback rewards and investment integration.

- N26: Features real-time spending updates and budgeting tools.

- Varo: Offers high-yield savings accounts and financial education.

Neo-Bank Features

- Mobile Payments: Easy peer-to-peer transactions.

- Budgeting Tools: Track expenses and set financial goals.

- Real-Time Alerts: Stay informed about account activity.

- Customer Support: Accessible assistance through chat or phone.

Security and Regulation

Neo-banks are:

- FDIC-Insured: Protects deposits up to $250,000.

- Regulated: Comply with federal and state banking laws.

- Encrypted: Secure transactions and data storage.

Who Are Neo-Banks For?

- Digital Natives: Comfortable with online banking.

- Frequent Travelers: Benefit from low international fees.

- Budget-Conscious: Appreciate reduced fees and higher interest.

Choosing the Right Neo-Bank

Consider:

- Fees: Look for low or no fees.

- Interest Rates: Compare rates for savings accounts.

- Customer Support: Evaluate support options.

- Mobile App: Assess user experience.

Neo-banks have redefined banking, offering convenience, savings, and innovative features. By understanding the benefits and top neo-banks, individuals can optimize their financial management. Explore the world of neo-banking with Winchell House.

You must be logged in to post a comment.